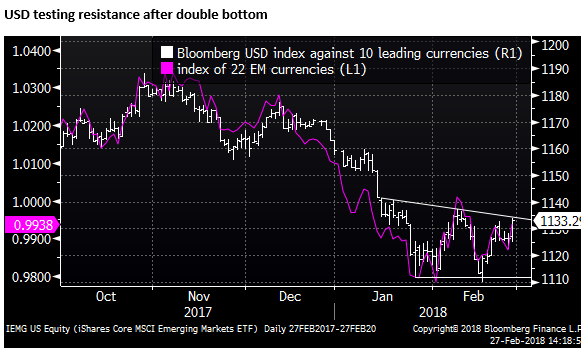

USD tests resistance after double bottom

The USD testing key resistance after a double bottom. Higher US yields and shaky equity markets lending the USD support. Powell acknowledged the outlook for the US economy is brighter. Emerging market currencies and equities wobble more than most in US trading. Powell testimony suggests risks are skewed towards faster pace of hikes.

US economic reports show acceleration and tightening labor market

US Durable goods orders were weaker than expected. Core capital goods orders (less aircraft and defense) were down for a second month in a row in Jan. But this comes after strong gains, particularly in July through October last year. Cold weather in January may also have dampened activity. Recent manufacturing surveys suggest that goods orders will continue to rise in coming months.

The Richmond Fed manufacturing index rose from 14 to 28 in Feb, above 15 expected. The employment component rose from 10 to 25, a new record high. This followed a rise in the Dallas Fed index to 37.2 a high since 2006, reported on Monday. The surveys point to strong growth in the energy sector.

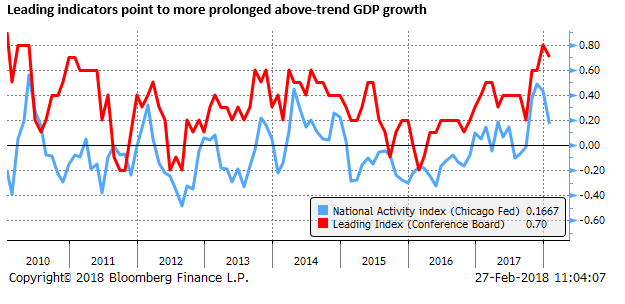

On Monday the Chicago Fed National Activity Index was revised down and below expected at 0.12. However, it was above zero for a fifth month in a row, the threshold for above-trend GDP growth, the longest stretch since 2014. The leading indicators, reported last week, suggest that the pace of the economy is picking up, rising more than expected in January, and rising around its fastest pace in the last few months since 2010.

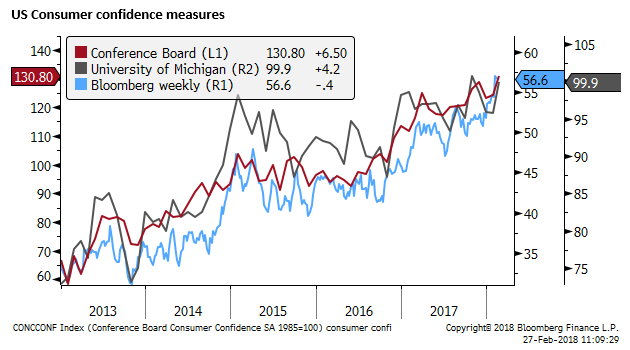

Consumer Confidence at highs, labor market tightening

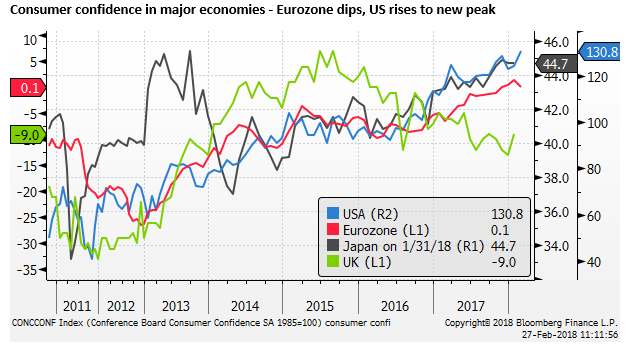

The Conference Board Consumer confidence reading for Feb rose from 124.3 to 130.8, a high since 2000. Similarly, other measures or consumer sentiment are around there long-term highs.

The recent tick up in consumer confidence and manufacturing surveys contrasts with a tick down in Eurozone measures. Overall momentum in Europe remains around long-term highs, but may be peaking as US momentum is picking up.

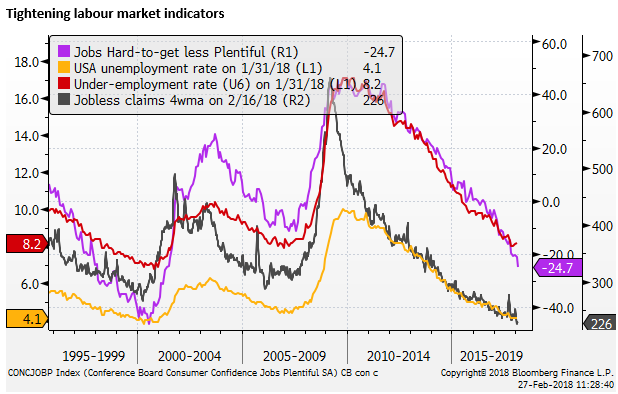

The labor market components in the Conference Board consumer survey point to a significant further tightening in an already, arguably, tight labor market. Jobs plentiful rose from 37.2 to 39.5, a high since 2001. Jobs Hard to Get fell from 16.3 to 14.7, a low since 2001. The difference between these two fell to -24.7, a low since 2001.

Weekly jobless claims were 222K, reported last week. The four-week moving average was 226K, around this level for the first three weeks of February, lows since 1973.

The data suggests the unemployment rate may fall below 4.0% as soon as the next data release. It has been steady at 4.1% since October.

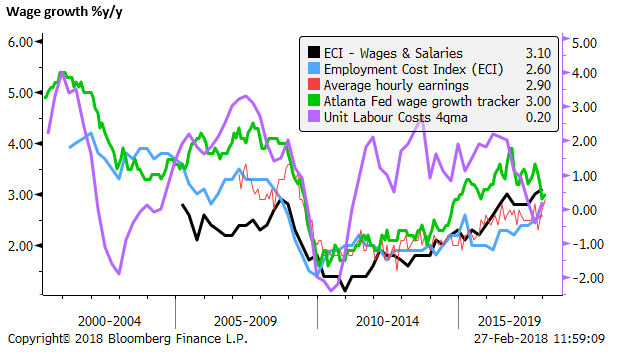

The wages data are perhaps the most important data point as the market seeks confirmation that the labor market tightening is starting to fuel faster wage growth.

The higher than expected average hourly earnings data in January (+2.9%y/y) triggered a significant reaction in the markets (higher US yields, stronger USD, and weaker US equities); despite weaker than expected payrolls growth. It arguably set off the major correction in equities, which fell in the following week to its low for the year.

However, the average hourly earnings data is volatile and there are mixed indicators of labor costs, so it remains to be seen if wages growth is clearly accelerating. The Atlanta Fed’s wage growth tracker has eased recently. However, the quarterly Employment Cost Index is showing a rising trend.

Powell Upbeat on growth outlook

In the face of the evidence of an economy growing solidly above trend, potentially accelerating, with a tightening labor market, Fed Chair Powell sounded upbeat.

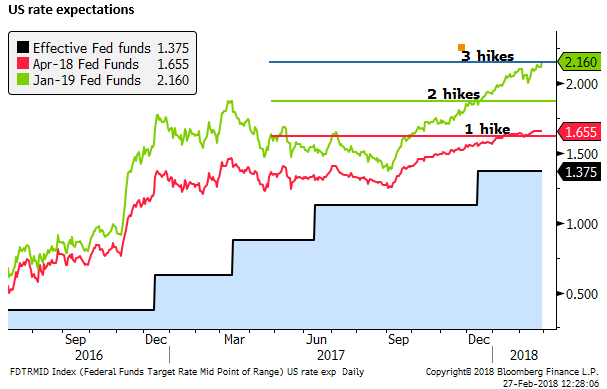

He said, “My personal outlook for the economy has strengthened since December.” As the Chair of the Fed, this raises the risks that FOMC members see the potential for a faster pace of policy tightening from the three hikes currently projected by the FOMC dot-plot.

Key takeaways from the prepared statement:

“After easing substantially during 2017, financial conditions in the United States have reversed some of that easing. At this point, we do not see these developments as weighing heavily on the outlook for economic activity, the labor market, and inflation. Indeed, the economic outlook remains strong.”

This suggests that the Fed is largely unconcerned with the recent market developments and unlikely to delay further policy tightening if equity markets remain lower or fall moderately further.

“The robust job market should continue to support growth in household incomes and consumer spending, solid economic growth among our trading partners should lead to further gains in U.S. exports, and upbeat business sentiment and strong sales growth will likely continue to boost business investment. Moreover, fiscal policy is becoming more stimulative.”

The fiscal policy comes in here as adding to demand growth at a time when the outlook is already robust.

“In this environment, we anticipate that inflation on a 12-month basis will move up this year and stabilize around the FOMC’s 2 percent objective over the medium term. Wages should increase at a faster pace as well. The Committee views the near-term risks to the economic outlook as roughly balanced but will continue to monitor inflation developments closely.”

Powell hits specifically on the highly sensitive subject of wage growth.

In gauging the appropriate path for monetary policy over the next few years, the FOMC will continue to strike a balance between avoiding an overheated economy and bringing PCE price inflation to 2 percent on a sustained basis. While many factors shape the economic outlook, some of the headwinds the U.S. economy faced in previous years have turned into tailwinds: In particular, fiscal policy has become more stimulative and foreign demand for U.S. exports is on a firmer trajectory. Despite the recent volatility, financial conditions remain accommodative. At the same time, inflation remains below our 2 percent longer-run objective. In the FOMC’s view, further gradual increases in the federal funds rate will best promote attainment of both of our objectives. As always, the path of monetary policy will depend on the economic outlook as informed by incoming data.

Headwinds are now tailwinds – suggesting risks to outlook turning more to a positive skew (even if the FOMC still describes risks as “roughly balanced”.

Semiannual Monetary Policy Report to the Congress; Chairman Jerome H. Powell – FederalReserve.gov

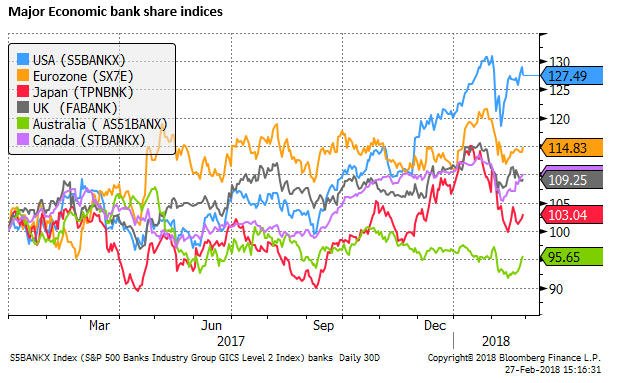

In questioning, Powell suggested he was amenable to some easing of the regulatory requirements on banks. The shift in tone may be one reason why US bank shares have been outperforming other countries’ bank shares.

Comments from Powell also appeared to admit that the US budget is not on a sustainable trajectory. He said, “We really need to get on a sustainable fiscal path, and the time to be doing that is now.” This speaks to one of the downside risks for the USD; that the market places a higher risk premium on US government bonds.

One more dovish comment was that Powell does not appear to view the labor market as tightly stretched as other FOMC members. On the neutral unemployment rate he said, “If I had to make an estimate, I’d say it’s somewhere in the low fours,” (compared to a median FOMC estimate of 4.6%).

Higher US rates

US rate hike expectations have lifted to now essentially fully price in 3 hikes this year, in-line with the FOMC December dot-plot

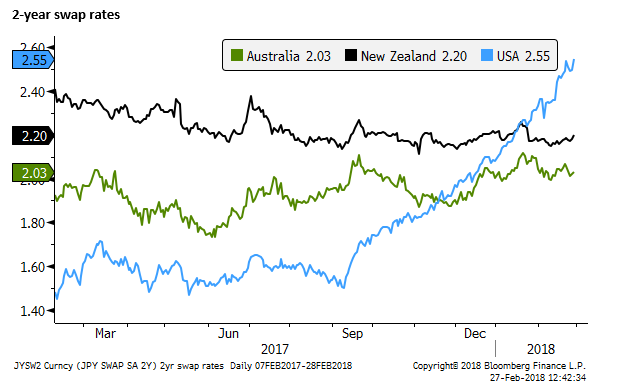

2yr swap rates in the US have made new highs at 2.55%, notably rising over recent months while remaining stable in many other countries. As such, it is getting costlier to short the USD.

10-year government bond yields have been ebbing in most countries in recent weeks, but have held near highs in the USA.

As we noted in our report last week, the USD has become historically stretched from its wider yield advantage against most other major currencies. This may reflect a number of factors, including concerns over fiscal and external balances, political uncertainty, and upbeat global investor sentiment, boosting demand for emerging markets.

However, we thought it might be time for some fight-back in the USD as it becomes stretched from interest rate developments, and policy tightening in the US tends to trigger more global market volatility.

Time for the USD to fight-back; 23 Feb – AmpGFXCapital.com

USD testing key resistance after double bottom

In the wake of the Powell testimony, global equity markets are weaker. While one trading session does not a trend make, emerging market ETFs have taken a significant hit down over 2.5% in US trading on Tuesday, reversing what looks like a promising start to the week on Monday, to be trading at the low end of its range for the last week, raising the risk a break lower.

Emerging market currencies have similarly more than reversed their Monday gains. More broadly, the USD may be showing signs of breaking out of its medium-term downtrend.

After essentially making a double bottom in recent months, The Bloomberg USD index again is testing the top of its range since mid-Jan