Wading through event risks – Trade, Brexit, Fed policy, US mid-terms

Hopes that the US and China will avert an all-out trade war and one low inflation print in the USA have sparked a ray of hope for emerging-market assets. Hopes that UK PM May can navigate a Brexit plan through a fractured UK parliament have lifted the GBP. The US mid-term elections are a risk for the continuity of US economic and trade policy. In these days of extreme controversy over the leadership style of the US President, we cannot discount political chaos come November. However, evidence of extreme tightening in the US labor market has kept US rates near their recent highs and may yet reassert USD strength.

A ray of EM hope

Emerging market equities and currencies have had a significant bounce in the last two days from lows for the year. Contributing factors are new trade talks proposed by the US Administration with China, a rebound in TRL on a larger than expected rise in rates by the Turkish central bank, and lower than expected US inflation data.

It is far too early to say EM assets should sustain a recovery, but it may stick in the near term. Much depends on Fed rates policy and trade relations between the US and China. It is far from clear that inflation pressure in the USA has stalled or that the US and China will hug and make up.

ECB and BoE stick to policy normalization guidance

The EUR and GBP rose after ECB and BoE policy meetings. Both central banks stuck with the main tenets of their projections including ending QE by the end of this year (ECB) and gradual rate rises (BoE). Both central banks also pointed to more robust evidence of wage rises to support their outlooks.

Draghi’s upbeat mood

The market may have thought there was a risk of more dovish tones in the ECB Draghi press conference. But Draghi was in a mood to emphasise the positive and downplay the negatives.

Despite the slight downward revision to the ECB staff growth forecasts by 0.1ppt this year and next, he reiterated the view expressed in recent policy meetings that the ECB had increased confidence in their forecasts for a gradual rise in inflation.

Despite saying in his opening statement that, “Uncertainties relating to rising protectionism, vulnerabilities in emerging markets and financial market volatility have gained more prominence recently”, Draghi said there had been no contagion to speak of to the Eurozone from emerging market or Italian market turmoil.

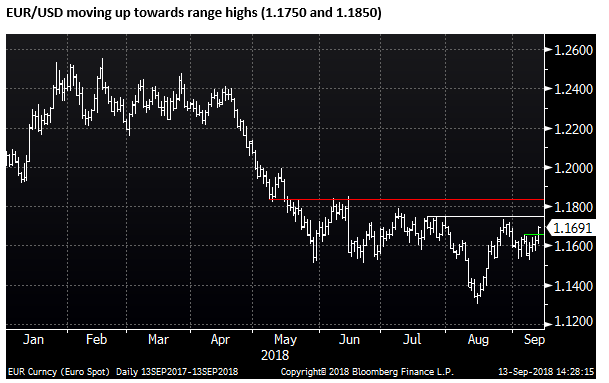

EUR rose above its recent narrow trading range around 1.1600 to be now testing its range highs over recent months. A key focus for the market now will be whether the EUR can push above 1.1750 and then 1.1850 that have been key highs for the currency pair since mid-year.

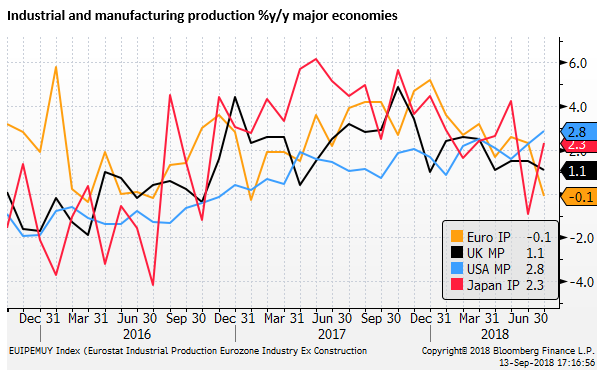

Eurozone falls to the bottom of the pile on industrial production

We wouldn’t be in a rush to buy EUR at these levels; ECB rate hike expectations remain distant. Draghi may have emphasised the positive, but recent economic reports suggest the economy is struggling to regain moment. Industrial production reported yesterday fell 0.1%y/y in July; the lowest of all major economies, down from +5.2%y/y in December 2017.

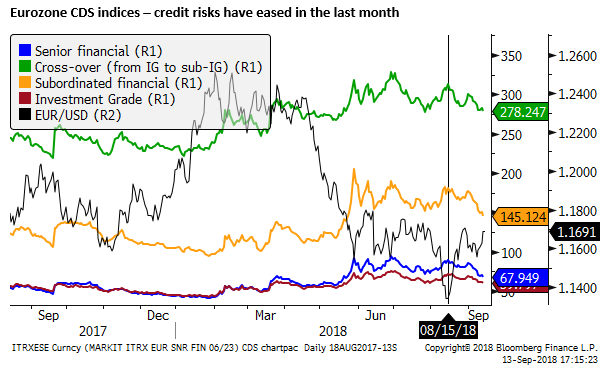

European credit risks ease

We wouldn’t necessarily say EUR can’t rise further. Italian bond yield spreads have eased from their peak recently. Eurozone equities have recovered from recent lows as emerging markets have stabilised. Credit spreads broadly in the region have eased.

However, risks remain, not least from the proposed tapering in ECB asset purchases in October and January that may place upward pressure on credit spreads in the region and make Eurozone assets more vulnerable to any tightening in global credit conditions.

Forward-Looking Rate expectations may cap EUR/USD

Looking at yield spreads between the US and Eurozone has not been particularly helpful in explaining movements in the EUR in recent years. But one metric that we have found somewhat useful is to consider the relative rate hike expectations one-year from now, one-year forward.

This analysis suggests that the market has been trading EUR/USD as if it has factored in near-term rate hikes in the USA, and is looking ahead to a time when the ECB may consider raising rates.

Today, the ECB reiterated its rate guidance first stated in July, that it does not expect to raise rates “at least through the summer of 2019”. What appears more important to the market is how fast the ECB may raise rates from around August/September next year. And whether the Fed may have finished hiking by then.

The chart below shows that these forward-looking rate hike expectations for the ECB have recovered since their recent low in mid-August, helping explain a recent recovery in the EUR. However, they did not rise further after the ECB meeting today.

Forward-looking Fed rate hike expectations have been low, suggesting that the market sees the Fed hiking cycle as likely to be close to finished by Q3 next year. However, these expectations did rise significantly after the US payrolls report on Friday included higher than expected wages growth. As such, this comparison suggests further gains in EUR/USD may stall

Its all about Brexit

The GBP/USD is also approaching significant resistance, its break-down level in early-August (around 1.3130).

The GBP/USD has been in a downtrend since April for the most part on increasing doubts that the UK and EU will come to an agreement on how to proceed with Brexit as key dates in the process draw near.

The GBP capitulated in early-August as PM May’s ‘Chequer’s Plan’, released on 9-July, fanned the flames of division in the Tory Party over how to proceed. Several members of PM May’s cabinet resigned and raised the spectre of a leadership challenge.

In recent weeks, the EU appears to have been moved by the UK political turmoil to try and help PM May by expressing a willingness to negotiate with a mind to accept key parts of the Chequers plan, raising hopes that PM May may be able to guide a deal through her parliament.

Much like hope of better US-China trade relations, hope of a Brexit deal remains very much up in the air, far from clear that it can get done. The UK parliament remains hopelessly divided and its capacity to compromise on any plan appears doubtful.

Recent UK economic reports have supported the GBP, including stronger than expected GDP and labour market reports in July. As the BoE pointed out today, underlying wage pressure has lifted to around 3.0%y/y.

However, there has not been any significant increase in UK rate hike expectations, certainly not as much as in the US in recent days, which sit at new cyclical highs.

The fortunes of the GBP hinge almost entirely on progress towards Brexit. A fear is that businesses are now acting on their contingency plans simply because time is now too short to wait to see if the UK parliament to hold together and agree on a deal with the EU. In which case we may see weaker economic reports and business confidence in coming months, especially if the UK parliament appears to remain hopelessly divided.

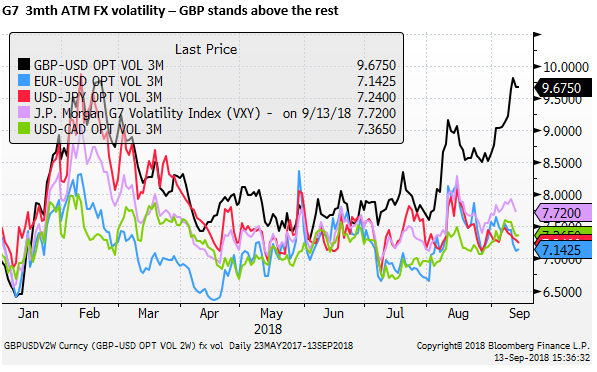

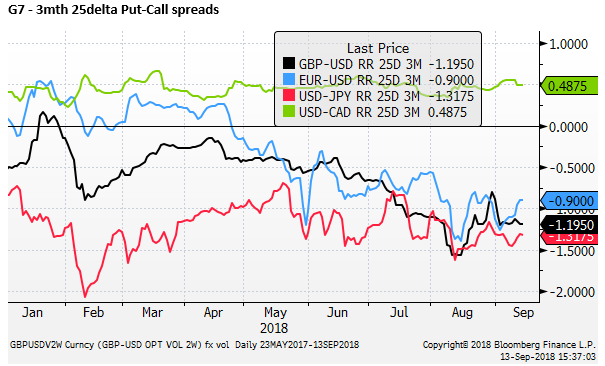

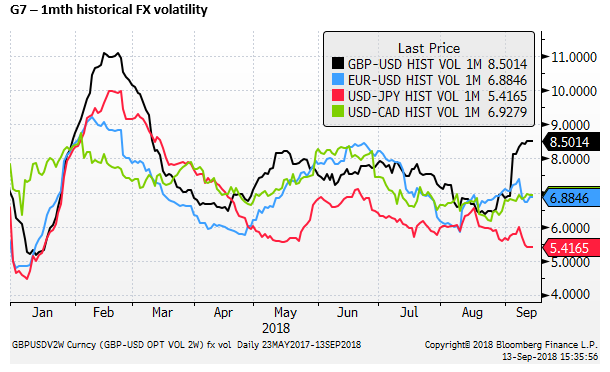

High GBP volatility

Elevated GBP implied volatility in the options market is a reflection of Brexit uncertainty. The chart below shows that three-month GBP/USD vol (9.68%) is far above vols for other major currencies (in the 7%’s)

The market is projecting more downside risk for the GBP/USD, more so since the Chequers Plan was introduced in July.

Consistent with the heightened political risk in recent months, actual volatility in the GBP has also increased.

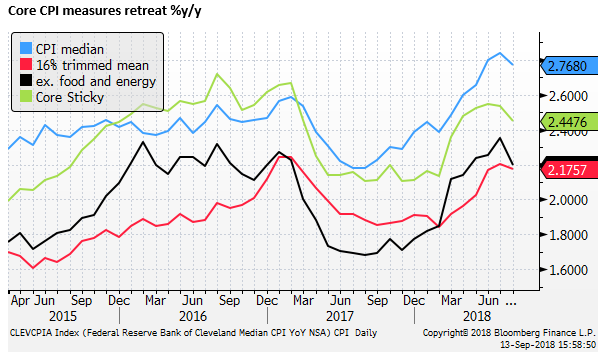

USA CPI low this time, but more evidence of tightening labor market

The US CPI inflation report might be considered a hurdle that the market has cleared today. As we noted in our report earlier in the week, as the US proceeds on its late-cycle fiscal adventure, inflation becomes a bigger issue for the Fed.

The USA’s late-cycle fiscal adventure kicks-in; 12 Sep – AmpGFXcapital.com

The higher than expected wages outcome on Friday, suggests that inflation pressure is building. Earlier this week, the small business survey and JOLTS job vacancy report further pointed to a very tight labour market. The Beige Book released on Wednesday, said, “Labor markets continued to be characterized as tight throughout the country, with most Districts reporting widespread shortages.”

US weekly initial claims and continuing claims fell to record lows in today’s report. It could be argued that the market is still too sanguine over the risk of a wages break-out.

The perception globally is that businesses are very reluctant to offer higher wages, but surely something has to give, and potentially very soon.

The core CPI (0.08%m/m, 2.20%y/y) today was much lower than expected and takes the heat out of fears that the Fed may have to tighten faster or further. However, US rates have hardly backed away from their highs.

Higher US rates have had a dubious effect on the USD in recent years. Nevertheless, higher US rates have contributed to tougher financing conditions for emerging market economies, generating some broader contagion this year, and indirect gains in the USD.

Emerging markets are recovering in recent sessions, distracting the market from higher US rates, but if the Fed retains its gradual policy tightening trend, we should expect strength in the USD to return at some stage.

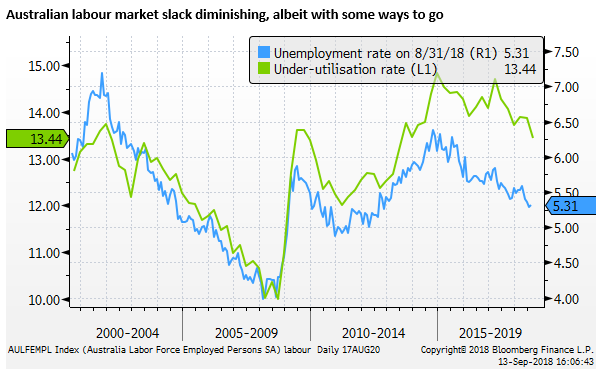

AUD still a risk proxy

The AUD has lifted more than the NZD and CAD on hopes that the US and China may avoid an all-out trade war. Also supporting the AUD was a strong employment report, continuing the theme of solid above-trend economic growth.

The unemployment rate was steady at 5.3%, a low since 2012, and the broad underutilization rate fell to 13.4%, a low since 2013.

AUD has been the embodiment of global market risks related to trade policy and broader emerging market upheaval. The solid economic data in recent weeks, including a much stronger than expected Q2 GDP report has hardly moved the needle for the AUD.

AUD the global risk barometer; 11 September – http://thewire.fiig.com.au

US political risk coming into focus

While we can see increasing inflation risks and rising US rates supporting the USD, the USD faces its own event risk with the approaching mid-term elections.

Despite the booming US economy, President Trump continues to court controversy and enrage much of the community. There is a risk of a ‘blue wave’ backlash against him that could sweep Republicans out of power in Congress come the mid-term elections.

My capacity to predict the US elections is no better than figuring out Brexit or US-China trade relations. Predictit.org that derives probability from trading in political events shows an increasing probability that the Democrats take control of the House (70%). However, it still has the Republicans as favoured to control the Senate (73%).

If Republicans retain control of the Senate, the market may not fuss too much. But if Democrats were to take control of the Senate and the House, then it will raise fear of political turmoil, including fear of historic moves to remove Trump from office, and intense pressure on the whole framework of government in the US. Certainly, the US establishment and media would be in a frenzy. And it would be hard to predict the fallout in global financial markets.

Considering the passions in the US electorate, we cannot discount the risk that Democrats take both houses in Congress. The results can swing on only a handful of races considering the balance is only 49/51 in the Senate.