Yellen’s framework and balance of risks point to four hikes this year and higher yields

Fed Chair Yellen may have sounded soothing two weeks ago. However, the framework she outlined is consistent with one more hike in the FOMC projections to four this year. And the balance of risks has shifted towards higher rates still next year. Risks, even without the possible fiscal stimulus, have been balanced for some time. Arguably, given stronger global growth indicators this year, buoyant sentiment surveys and a stronger equity market, those risks have now tilted to the upside. As such, the market should remove its bias to predict the Fed moves slower than its median projections.

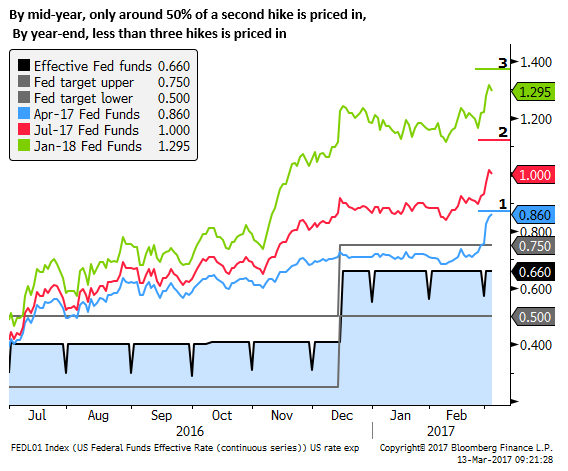

Market still projects less than three hikes this year

Even though the market is now fully prepared for a 25bp rate hike on Wednesday, it is still not pricing in three rate hikes through this year in total. It has around a 50% chance that the Fed follows up on June 14 with a second hike this year.

In December last year, at the last FOMC Summary of Economic Projections, most members predicted three hikes this year (6 out of 17), three hikes was also the median of the projections.

The market has consistently priced in fewer hikes than the FOMC’s median forecasts over recent years. And the market has been right – the Fed has delayed hikes well beyond its projections over this period. The market is creeping closer to the FOMC median projections, but remains a step behind.

After the December policy meeting, the market moved to price in two hikes this year, one around mid-year and one near year-end. In the wake of the Fed members’ rate talk two weeks ago, the market has moved to price in more chance of three hikes, this year, but remains still a bit behind the December projection for three hikes.

The market still thinks the Fed will drag its heels

The fact that the Fed appears ready to follow up its December hike so soon (three months later) suggests it is more serious this time, and might at least stay on its previous projection of three hikes this year.

In her speech on 3 March, Fed Chair Yellen said, “Unless unanticipated developments adversely affect the economic outlook, the process of scaling back accommodation likely will not be as slow as it was during the past couple of years.”

This does suggest Yellen is more confident that there will be more hikes this year after March, but it still leaves the bar pretty low when the Fed was on an extraordinarily slow one hike per year pace in 2015 and 2016.

The market is still biased to think the Fed is more likely to pause and leave rates steady than it is to speed-up, even though the Fed has essentially just sped up.

The market either does not believe the Fed will raise its projection for rate hikes, and/or, continues to think the Fed has a bias to fall behind its own rate forecasts.

Yellen soothed, but her framework points to four hikes

Yellen’s speech on 3 March did not aim to raise market expectations of more than three hikes this year. Her aim was mainly to prepare the market for a hike this week. Perhaps this reflected a desire to warn but not panic the market.

Most of her speech was an historical account of Fed’s rate policy decision-making. It gave a sense that not much had changed since December, and a hike this week would be just one step in getting on with this process of policy tightening; at a faster pace than seen in recent years, but still gradual.

In her 3 March speech Yellen noted that the FOMC has revised down its estimate of the neutral long-run real Fed Funds rate over recent years; “from 1-3/4 percent in June 2014 to 1-1/2 percent in December 2015 and then to 1 percent in December 2016.”

“In the Committee’s most recent projections last December, most FOMC participants assessed the longer-run value of the neutral real federal funds rate to be in the vicinity of 1 percent.”

Furthermore, she noted that the current neutral rate is lower still. She said, “Some recent estimates of the current value of the neutral real federal funds rate stand close to zero percent.”

The point of this discussion was to highlight that the Fed is still in a gradual tightening cycle and is likely to raise rates by less over this cycle than past ones.

Using the current zero neutral real rate estimate, the recent core PCE deflator (1.7%y/y in Dec), and the current effective Fed Funds rate of 0.66%, the current effective real rate is about -1% (one percent below the zero estimate of neutral). This is moderately accommodative, justified mainly by the fact that PCE core inflation (1.7%) is below the 2% target.

If we were to use the December FOMC median projections for end-2017 (unemployment 4.5%, less the 4.8% neutral estimate, core PCE inflation 1.8%, less than 2.0% target), and assume the current neutral real policy rate remained at zero, three hikes would leave the effective real rate at (1.37% – 1.8% = -0.43%) still accommodative at 0.43% below neutral.

This might be justified since core inflation (1.8%) would still be below 2.0%; although at this stage the labor market might be a bit too tight relative to the Fed’s mandate.

However, consider what may have changed since the December policy meeting. Firstly, the FOMC’s year-end inflation projection appears low. Already the preferred core measure is at 1.7%, only 0.1% below the Fed’s year-end median projection. Moreover, a number of alternative measures of underlying inflation are higher. (Atlanta Fed’s PCE trimmed mean measures at 1.9% in January; Fed already behind the curve, USD looks cheap compared to yield gaps, NZD expensive – ampGFXcapital.com). These suggest that the Fed’s choice of the most conservative measure of core inflation is likely to rise towards these alternative measures if the economy remains on its current path. As such, it seems likely that there will be some upward revision in the FOMC’s year-end median inflation forecast.

Secondly, consider the FOMC projections of the neutral real rate. It may be too soon to expect to see much upward revision in the long-run neutral real rate from 1% (although this certainly implies a pessimistic view of potential real growth). However, it is likely that FOMC members begin to upgrade their current neutral rate from zero, or at least will project it to be above zero by year-end.

On 3 March, Yellen noted that the lower current neutral rate reflected “several additional headwinds to the U.S. economy in the aftermath of the financial crisis, such as subdued economic growth abroad and perhaps a lingering sense of caution on the part of households and businesses in the wake of the trauma of the Great Recession.”

Fed member comments earlier in the week of Yellen’s speech highlighted that the global economic outlook had improved and consumer and business confidence in the USA had lifted to its best level in some years. As such, those headwinds that were dampening the current neutral rate appear to have eased significantly since last year. As such, it may already be the case that the neutral real rate is projected to be above zero

A higher estimate of the neutral rate and a higher estimate of core inflation suggests that FOMC members, including Yellen herself, should be considering raising their projection for rate hikes this year from three to four.

Furthermore, the balance of risks around growth and inflation are likely to have tilted higher.

Balance of Risks Improved

In its 1 Feb policy press release, the FOMC said, “Near-term risks to the economic outlook appear roughly balanced. The Committee continues to closely monitor inflation indicators and global economic and financial developments.” This repeated the same words since the outlook for risk was upgraded to “balanced” in September last year, after spending much of last year with more risk seen to the downside.

In his speech on 28 February, NY Fed President Dudley suggested the balance of risks were now tilted to the upside; contributing to an urgency to hike “fairly soon.” He said, “After the election we’ve seen very large increases in household and business confidence, we’ve seen very buoyant financial markets — the stock market is up, credit spreads are narrow. And we have the expectation that fiscal policy will probably move in a more stimulative direction. So, put it all together, I think the case for monetary policy tightening has become a lot more compelling.”

On the effect of fiscal policy Dudley said, “We do know that fiscal policy is going to move in a more stimulative direction. So what that says to me is that the risks to the outlook are now starting to tilt to the upside. So while I haven’t really built it into my GDP forecast, when I think about the balance of risks — up or down in terms of economic activity — I think the fiscal side tends to push things — the risks to the upside.”

Even if the FOMC may be reluctant to actually build-in higher fiscal policy into its forecast, it should tilt the risks higher. If the market begins to think the same way, it may start to project rates rising faster than projected by the median FOMC projection.

The rates market has been conditioned to project fewer hikes than the Fed projects, but the equity market appears to be building in tax cuts and more fiscal spending, and the risk is that this expectation starts to filter into a higher yields and/or USD exchange rate expectations.

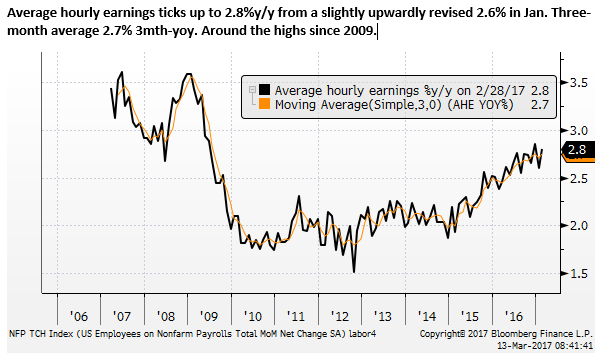

US labor data report ticked all the boxes