It appears central banks have pivoted towards delivering more policy easing to bolster inflation expectations that have plumbed new lows this year. The Fed has the greatest scope to ease policy, and the prospect of deep rate cuts have undermined the USD. However, the Fed is struggling to gain the initiative and appears to be reacting to market pressure and outside criticism rather than setting its own agenda. Gold has broken the range highs over the last six years and may have further to run as central bank policy easing sends investors in search of alternatives to fiat currencies. Trump’s attacks on the Fed’s independence and threats against other countries alleged attempts to devalue their currencies cannot be helping the dollar and adds support to gold. A range of geopolitical risks driven by unprecedented US administration aggression may further support gold. A G20 attempt to restart US-China trade negotiations may provide a reprieve for the USD and US yields, and provide a dip in gold. Facebook’s Libra represents yet another threat to the USD. Its announcement in the same week as Trump stomps on the institutional underpinnings for the USD is a foreboding sign.

Central bank pivot

I have been out of the office for the last two weeks, at it seems I had a lot to catch up on. The most obvious development is that the ECB, Fed, and RBA have kind of panicked and hinted they are prepared to ease policy a lot and soon.

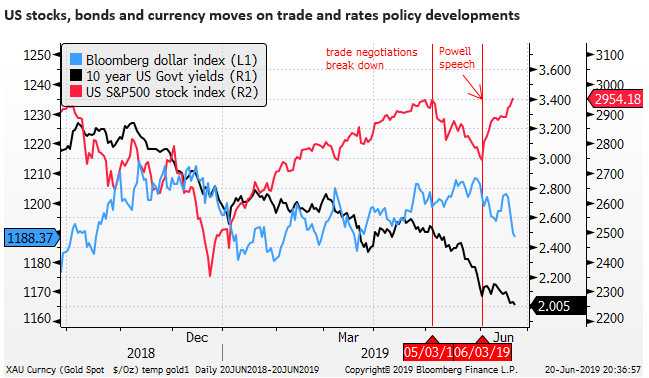

Global bond yields had already started a renewed push lower from around early May when the mood on trade negotiations between the US and China turned from optimism to collapse.

There have been several developments since April that progressively upended confidence in the global economy. Both the US and China escalated the trade dispute including the US adding Huawei to its “entity list”. The sense that US trade disputes could extend to other nations (EU, Mexico, India, Australia) undermined global investor confidence.

In the meantime, trade and manufacturing data in China and Europe and other trade sensitive countries failed to pick-up from its rapid slowdown through the last half of last year, suggesting trade tensions were already having a real dampening impact on the global economy.

The global recovery narrative crumbles; 24 May – AmpGFXcapital.com

Central banks had shifted to a more dovish tone through the course of this year. However, they were trying to hold to their broad game plan. The ECB ended QE asset purchases in December, the Fed said they would be patient, and the RBA was holding out for a stronger labour market to deliver higher wages.

Two weeks ago, US equities were hitting their lows in around two months, as escalating trade wars fueled fears that US companies would suffer along with China and the rest of the word, if not more. US bond yields resumed their fall, causing yield curve inversion, sending a signal that recession was a growing risk.

The Fed started to wilt under the pressure applied by weaker equities, falling bond yields and some ebbing in US economic indicators; even though overall the economic outlook remained for moderate growth.

Just before we left for our break, on 3 June, Fed Chair Powell gave his first sign that the Fed was prepared to accept it may have to cut rates. In a speech on the Fed’s big review of its approach to monetary policy, he opened with “I’d like first to say a word about recent developments involving trade negotiations and other matters. We do not know how or when these issues will be resolved. We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective.”

Will Powell come to the party; 4 June – AmpGFXcapital.com

By this stage, the market was already wagering that the Fed would need to cut rates in coming months, and it eagerly lapped up the first signs that the Fed was relenting on its “patient” message.

The US stock market stabilised after this 3-June Powell speech, while rate cut expectations increased.

Pressure for the Fed to deliver on cuts intensified with falling ISM manufacturing data on 3 June (52.1) weak jobs growth (75K) and softer wage growth (3.1%) on 7 June, and weaker CPI on 12 June (core 2.0%). There were some other solid data releases, but with growing international growth risks, the growth outlook is more subdued.

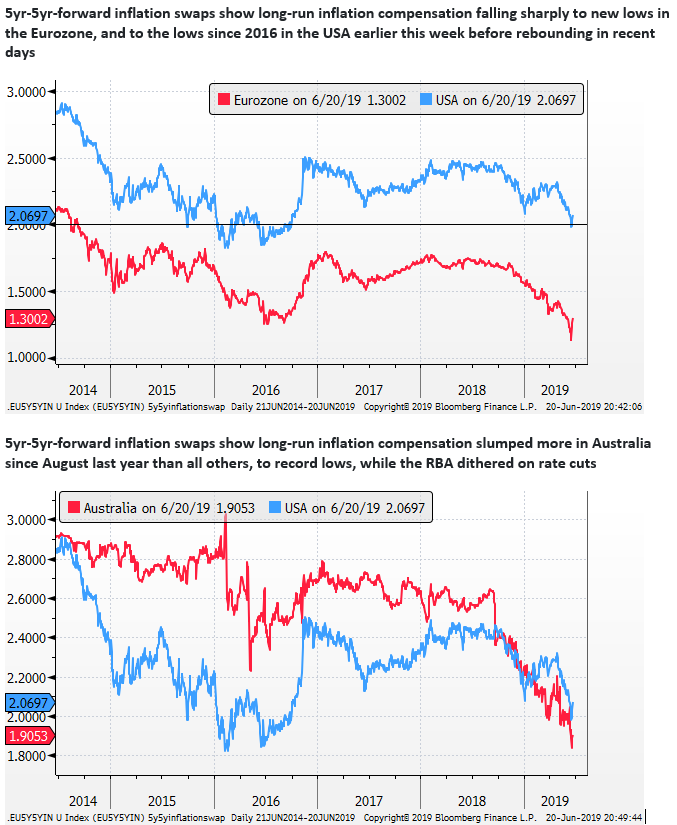

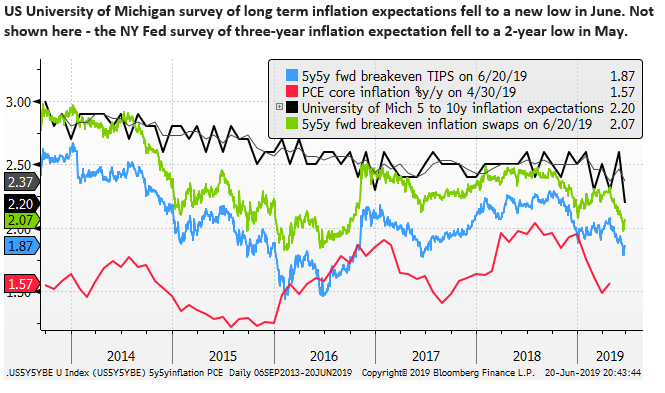

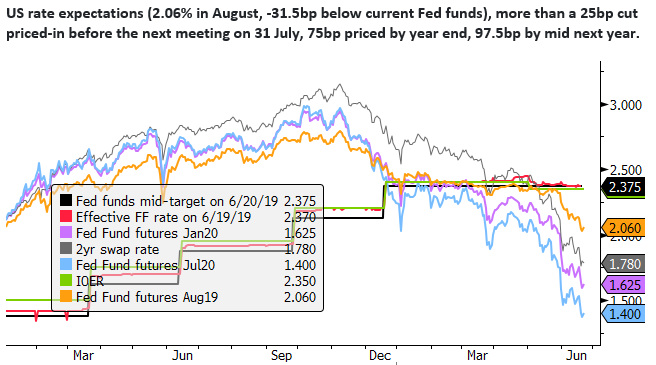

More importantly, it appears that inflation expectations have deteriorated this year, globally and in the USA. Inflation outcomes this year in the USA have undershot market estimates since February. The Fed had emphasised earlier in the year that this appeared to be driven by transient factors. However, its internal debate, driven by its big review of monetary policy, has suggested it should consider running inflation above target for an extended period to compensate for several years of sub-target inflation to help underpin long term inflation expectations.

Fed losing its cred

It is probably fair to say that the Fed has felt chastened by external criticism, including by President Trump, that it was too eager to raise rates last year when inflation outcomes remained muted. With evidence that inflation expectations were again drifting lower in recent months, the Fed may have become willing to deliver rate cuts even if the growth outlook might slow only modestly.

In any case, the market has been pricing in risks of a more significant hit to US and global growth, so the Fed might appear little to lose from delivering rate cuts.

In fact, with inflation expectations down in recent months, the Fed might appear at risk of falling behind the curve.

Fed’s Powell came to the party at the FOMC meeting this week. He gave a clear signal that cuts are now being considered and the case is already pretty clear that a cut is likely at the next policy meeting on 31 July.

However, a key problem for the Fed and the market is that since last year, the Fed has appeared slow to keep up with changing economic and market conditions, and is being pressured to act by the market and outside critical voices.

The market does not have a good understanding of what the Fed’s reaction function is anymore; the Fed chair appears to lack confidence as a leader of policy thought and direction.

Powell’s press conferences touch of a bit of everything but fail to provide a clear guide to how the overall balance of factors drives the policy outlook.

If the Fed cuts in July, will it be to address low inflation expectations? or weaker business confidence on trade wars? If trade negotiations restart after the G20, will that affect the decision? Will the level of the stock market, bond yields, credit spreads and the dollar play a role in rates policy?

Fed messaging is muddled, and it has appeared stuck on a path, until forced by market conditions to adjust course. It stayed on the rising rate and QT path (set by Powell’s predecessor Yellen) too long last year, and then stayed on the neutral patient path too long this year. Arguably, it could have been showing more concern over weak global economic conditions and softer inflation outcomes well before June. It could have moved the bias in speeches and press coverage before its meeting this week and delivered a cut already.

One is left to wonder if the degree of dovishness shown by Powell on Wednesday was driven by a strident speech by ECB President Draghi a day earlier.

No one will accuse President Draghi of failing to set a direction for the ECB. In fact, Reuters reports suggest that a good number of the ECB Governing Council were confounded by the dovish tilt by Draghi in his speech on Tuesday.

The market is pricing in a virtual certainty that the Fed cuts by 25bp and around a 20% probability that they take the extraordinary step of cutting by 50bp.

The idea that the Fed would feel the need to slice 50bp off rates when they are not historically all that high to start with, the stock market is close to a record high, and unemployment is at a record low, seems far-fetched.

It speaks to the heightened uncertainty around trade, tensions with Iran and the state of the global economy. It also suggests that the market thinks the Fed is already behind the curve and perhaps should have cut rates this week. And it reflects a degree of uncertainty over what is motivating the Fed’s rate policy. If it has a new resolve to restore inflation expectations and reduce the chances of needing to reach for QE down the track, it might argue for cutting rates more aggressively quickly.

The bottom line is that Fed Chair Powell’s press conference failed to provide much guidance other than rate cuts are now on the table, and appeared to reinforce the appearance of the Fed being led by the market rather than the other way around.

Transcript of Chair Powell’s Press Conference; June 19, 2019 – FederalReserve.gov

Frothy asset markets out of step with rapid rate cut expectations

I’m not going to say a 50bp cut is out of the question, but it hard to see the Fed delivering a supersized rate cut if the US stock market retains its recent rebound to around record highs.

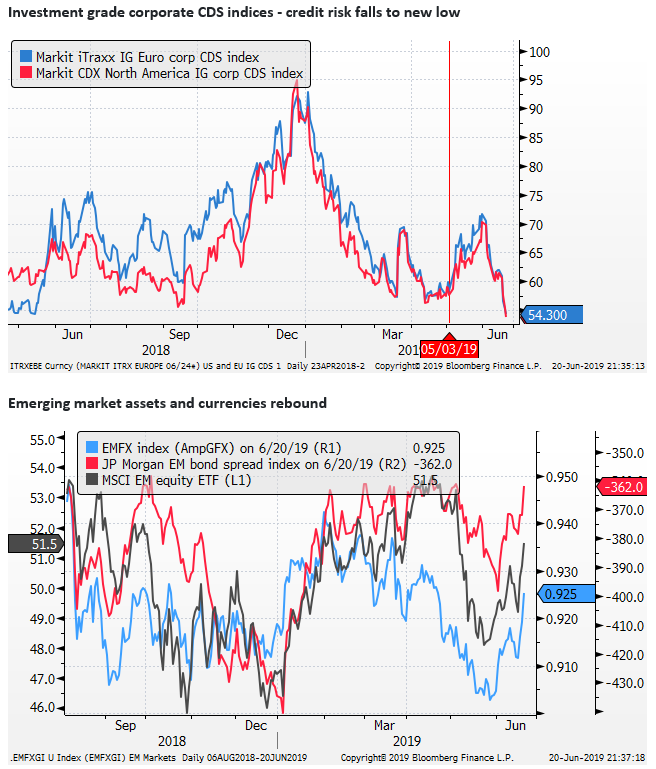

There is little doubt that lower bond yields and rate cut expectations have boosted equities, but the wide divergence between bond yields at a low since 2016, and equities near record highs is lacking some consistency over what they imply for the global economic outlook. Other indicators of global risk appetite have also rebounded with equities. Credit spreads and emerging market assets have rebounded in the last two weeks. Further suggesting that the Fed might take a more measured approach to rate cuts.

Of course, between now and 31 July, equities and other riskier assets might not be so elevated, and a downshift in risk appetite might make a 50bp rate cut appear more likely. The Fed did kick off its last two policy easing cycles with 50bp cuts in 2001 and 2007. Nevertheless, current market conditions suggest risk assets are either unreasonably frothy, or rate cut expectations are excessive, both for July and through the next year.

I would tend to suggest it is a bit of both, bond yields are now too low, and the rebound in equities are overdone.

Nevertheless, risky assets are pricing in more aggressive broad-based central bank policy easing in a rejuvenated effort to lift inflation expectations, and underpin global economic growth.

Gold breaks the shackles

We have been looking for a setback in the USD and resurgence in the price of gold for some time. Lower bond yields, increasing expectations that the Fed would need to cut rates and upheaval in global equity markets since early May seemed like a strong combination for gold.

The USD has been reluctant to respond to lower US yields because alternative currencies had problems of their own. EUR has struggled with weak Eurozone growth, weaker inflation expectations, tensions over Italy’s budget, potential fracturing in EU parliamentary elections, and rising Brexit uncertainty.

GBP was deteriorating on rising Brexit uncertainty and CNY fell in May as trade negotiations broke down, along with other Asian currencies exposed to the high tech sector and global trade.

The lack of response in the USD to falling US yields and technical resistance for gold at around $1350/60 per oz may have delayed a break up in gold until this week.

Falling inflation expectations also may have delayed a break-up in gold.

The rebound in global risk assets might tend to lessen demand for safe-haven currencies like gold, JPY and CHF. However, in the last week, the rebound in risk assets and safe haven alternatives have been driven by the same factor, a weaker USD on expectations that the Fed will begin a rate cutting cycle in July.

We tend to think gold will retain its recent gains and potentially move further ahead. Its strength may have more to do with underlying weakness in the USD. While it may be still hard to find a clear alternative to the USD in the currency space, gold may appear to gain as a hedge against central banks that are arguably moving into a new round of competitive devaluations to attempt to raise their domestic inflation rates.

As noted above, the Fed hasn’t exactly been clear about what its policy objectives are, but we suspect it is likely to work harder to raise inflation expectations, and will be prepared to cut rates significantly to do so in the coming year or so.

It is possible that gold takes a set back around the G20 summit if Trump and Xi come away from their meeting exhibiting renewed confidence that a trade deal is back on track, and bond yields recover some of the recent falls. The need for safe assets and an alternative to the dollar and its falling yields will lessen).

However, the outlook for global growth may remain more permanently harmed by the lack of recovery seen to date this year and the uncertainty over the protracted and broadened nature of the trade dispute.

The dye appears to be cast for lower rates policy and possibly more QE to address lower inflation expectations around the world. More aggressive monetary policy easing might be expected to see demand rise for alternative stores of value.

Trump attacks of Fed and dollar support gold

It is difficult to quantify its importance, but it is significant that the Trump administration has been persistently highly critical of Chair Powell and the Fed, arguing for lower rates and QE.

In this context, the administration has also claimed other countries are using monetary and intervention policy to depress their currencies against the USD. In particular, it has argued that China and the ECB have actively pursued weak currency policies. And it has made implicit threats that its tariff/trade policy may be used to discourage currency depreciation in these currencies.

The US administration has essentially called for a weaker USD and policy easing by the Fed to achieve these ends.

It may seem unthinkable by the standards of conventional norms to consider the possibility that the Trump administration might attempt to remove Chair Powell from his position as Fed chair. But Trump has become increasingly confident in breaking conventions and institutional norms. We cannot discount the possibility that the US administration attempts radical measures to achieve these ends

Even if this might prove hard to do, any attempt to do so might trigger a sense of crisis of confidence in the current anchor in the global financial system.

The bottom line is that the appearance of independence of the Fed from the government has been significantly eroded by the Trump administration, and this weakens the USD as a store of value and arguably increases the reliance on alternatives, including gold.

Tensions between the US and Iran have ratcheted up over the last month, and this has also probably provided some additional support for gold. Not to mention heightened stress between the US and China.

There have been several reports over the last six months or so that central banks including Russia and China are increasing their reserves allocations to gold.

Central bank buying gives gold market new lustre; 2 May – FT.com

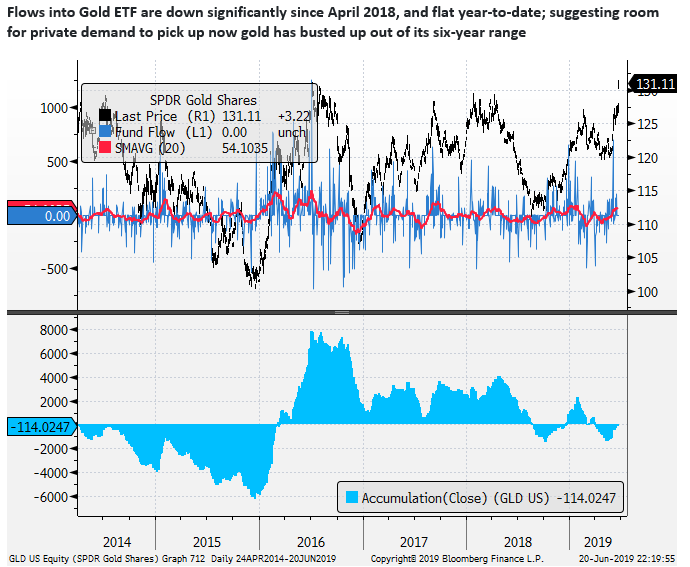

On the other hand, private sector investors appear to have been sceptical that gold will bust out of its six-year range. Accumulated flows to the SPDR Gold ETF have been negative over the last year. While inflows have picked up over the last month, they are still down on the year-to-date.

Facebooks Libra a foreboding sign for the dollar

We also see the announcement by Facebook on its plans with other mainstream private sector companies to introduce a cryptocurrency (Libra) linked to a basket of currencies as a very significant threat to the role of the USD as a store of value asset.

Naturally, this is being seen as a threat by US and other policymakers for a variety of reasons, and it’s a broad topic worthy of detailed discussion in its own right. We may attempt at a later stage.

But applying broad-brush strokes, we can see this as a developing into a big step forward for crypto finance. The prospect of a stable crypto coin backed by a powerful private sector lobby, aimed at developing high-level regulatory infrastructure, built within highly financed and capable tech companies, offers considerable advantages over the dollar as an international medium of exchange and store of value.

It is not surprising that the potential of Lybra appears to have given Bitcoin another push forward as a legitimate store of value. The broader acceptance of cryptocurrencies will raise the basis for treating bitcoin as a form of digital gold.

There is a degree of irony and foreboding coincidence that in the same week that Facebook unveils details on Libra, Trump stomps on the credibility of the USD, the current standard for the global stable medium of exchange.

The prospect of a diminishing role for the USD in global finance and the US government attacks on the Fed’s independence and government institutions threatens to further fuel investor demand for gold.

Comments