AUD may suffer a redux of the old economy blues

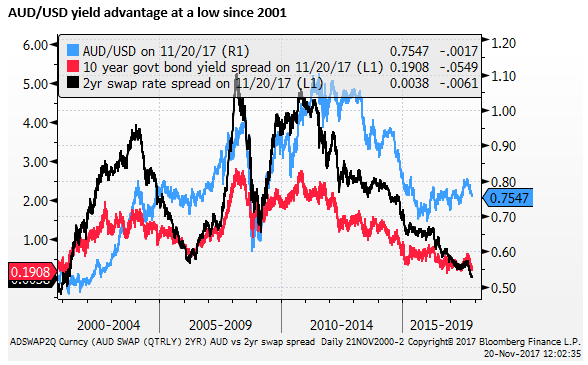

Around two decades ago AUD was languishing at record lows labelled an old economy left out by the ‘new IT economy.’ It feels a bit like its happening all over again. Australia’s interest rate advantage has slipped, and its equity market is under-performing. On Monday, US 2yr swap rates rose to a cyclical high and converged with falling Australian rates for the first time since 2001. Equity capital flows are playing a bigger part in driving currencies in the last year, and on that front Australia looks equally underwhelming.

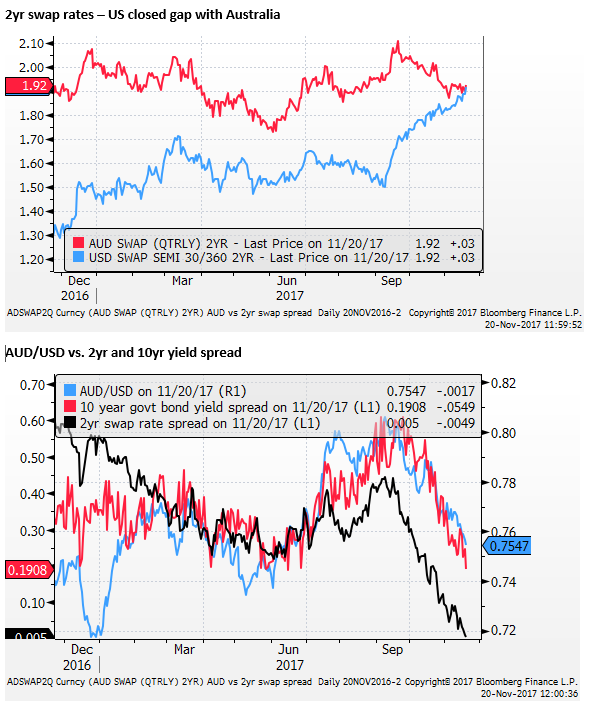

AUD/USD 2yr yield advantage disappears

USA rates have risen to a new cyclical high (1.92%) on Monday (up 3bp), converging to the same level as Australian 2yr swap rates.

The last time the 2yr spread was zero and below was 2001 when the AUD/USD was trading in the mid-0.50s. The 10-year government yield spread is also around its lows since the early-2000s (less than 20bp).

The USD has trended down this year, even as its yield advantage has increased. So interest rates are not front of mind in the FX market. Nevertheless, they have still played a part, helping account for the USD recovery since September.

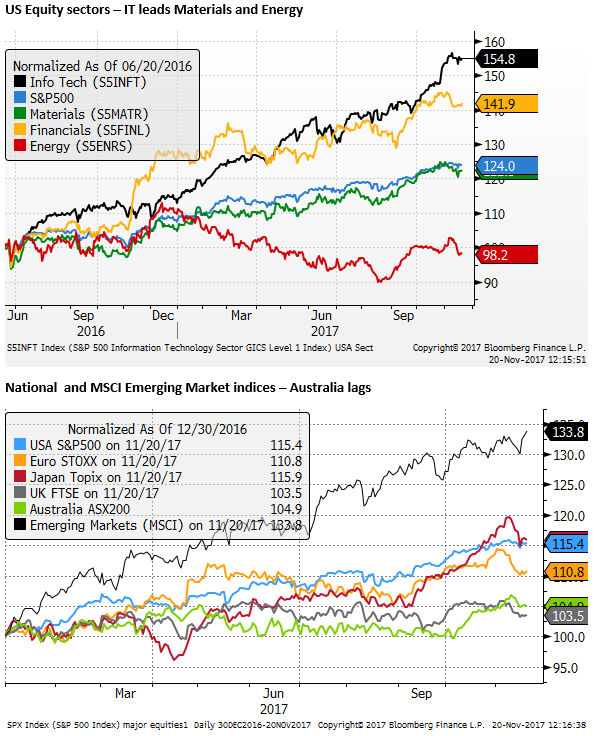

Australian equities have underperformed

Equity market flows have played a bigger role this year (as we discussed our report: IT disruption driving up Asia EM currencies, GBP risk builds, AUD yield advantage gone; 17 Nov – ampGFXcapital.com), but Australian equities do not offer the same degree of attraction as many other countries’ equities. IT stocks in Asia, have performed much better and appear to be attracting more capital inflow, supporting Asian currencies.

In a redux of the ‘old vs. new economy’ theme that undermined the AUD two decades ago, we could be moving into a similar phase where Australia is seen to be lagging the global trend towards more spending on high tech industries.

The Australian share market has underperformed major equity and EM markets year-to-date; sitting only just above the UK share market that has been held back by Brexit uncertainty.

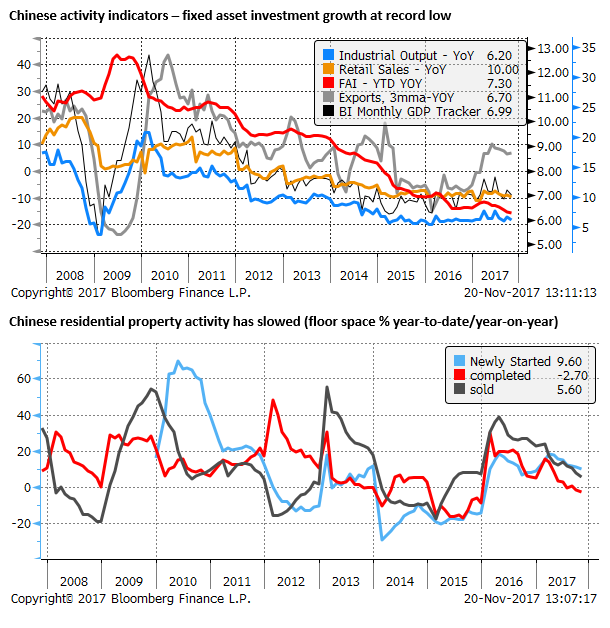

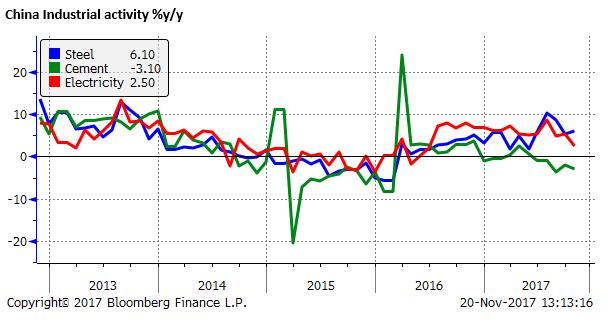

Australia leveraged to old China growth drivers

Australia appears to be leveraged to the old economy in China (heavy industry and construction). The market now views China as a leader in high tech industries and increasing led by services sector growth and consumption expenditure.

Construction and fixed asset investment in China are still significant and support commodity demand, but fixed asset investment growth has slowed and has been declining in importance as China looks to modernize, reduce pollution, and control speculation in the property market.

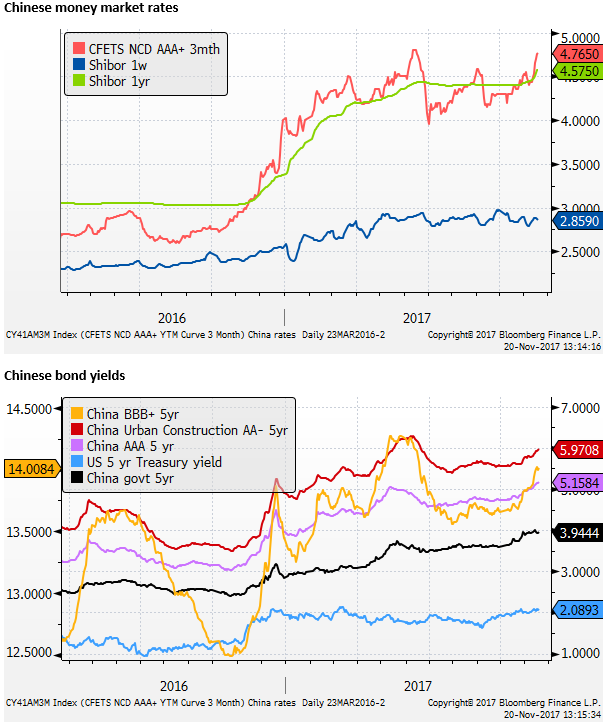

Tightening Financial conditions in China

The AUD has also been used as a proxy for Chinese financial risks. Recently, Chinese corporate bond yields have been rising. NCD rates have also risen, evidence that funding pressure on wealth management products (WMP) is tightening.

China announced new rules it plans to introduce in 2019 designed to reduce excess risk-taking, leverage, and moral hazard in WMP.

China Clampdown Signals ‘New Era’ for $15 Trillion in Funds – Bloomberg.com

It’s not the full redux

The old vs. new economy theme sent the AUD to record lows in the early-2000s. In the wake of the Asia currency crisis in 1998 and before China emerged to drive a commodity boom, Australia truly did appear to be left behind by the then ‘dotcom’ boom.

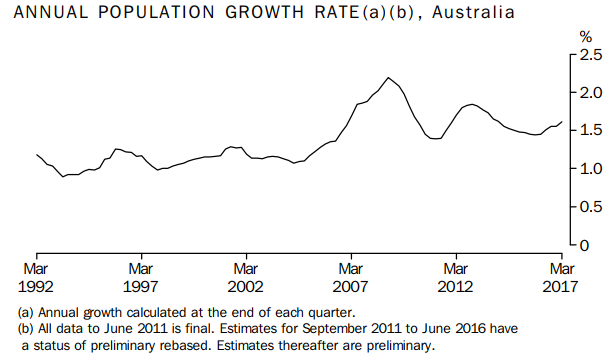

Asia is now widely seen as the most dynamic region in the world, and Australian has and continues to benefit from solid growth in the region, including for its education and tourism services and property. Immigration has driven a faster rate of population growth in the last decade (1.6% in the year to March-2017), supporting construction and overall demand.

Source: ABS Australian Demographic Statistics, Mar 2017 – ABS.gov.au

The Australian economy is forecast by the RBA to grow somewhat above trend for the next two years supported by strong government infrastructure spending and recovering non-mining business investment.

However, the nation is also dealing with relatively high household debt and a slowing housing market. This represents a significant structural headwind and appears to be dampening consumer confidence and spending.

Political risk in Australia

Politcal risk is playing a part in several currencies, as we discussed in our report Political risk for a number of currencies (AUD, NZD, GBP and CAD); 14-Nov – ampGFXcapital.com), including the AUD. The government’s majority is razor thin after a dual citizen crisis forced several MPs out of office.

In one of two bi-elections in December, the ruling Liberal National Coalition member forced out of parliament for having dual citizenship is facing a tough battle for re-election on 16-December.

It is possible that more dual citizen bi-elections will be held next year. In any case, a national election is likely in August next year (if not sooner), and a change of government appears likely.

Neither side of politics is inspiring public confidence, and the Labor Party is proposing policies that may undermine confidence in the housing market that is already slowing.