Major moves afoot (EUR, CAD, NZD & AUD)

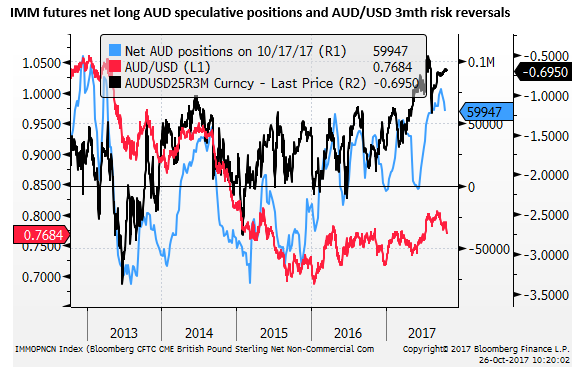

Major corrective moves may be underway in EUR and NZD. Further weakness may also be in stall for CAD and AUD. In the case on EUR, CAD and AUD, long positions and bullish sentiment leave them vulnerable to position-squaring. The EUR has moved too far from its yield disadvantage, and it is not as cheap as some might have you believe. The Bank of Canada has moved into a watch-and-wait mode. The political shockwave in NZ may be the catalyst for a major realignment in the NZD’s long-run over-valuation. AUD is suffering from weaker house price growth in Australia and China, the RBA is badly missing its inflation target, and its politics are hardly a shining example for any country.

ECB deliver only the expected, with some dovish elements

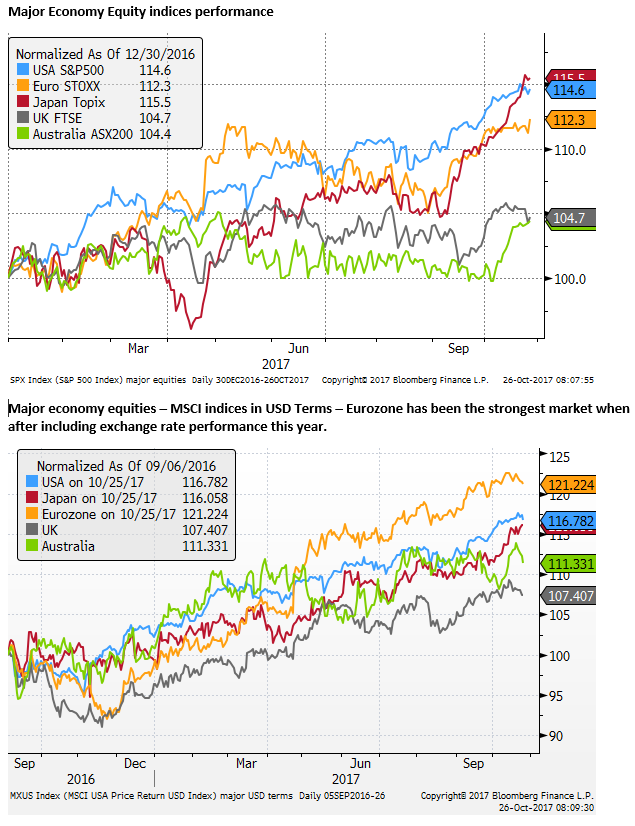

The ECB delivered the expected outcome in terms of the size and length of its second taper. However, the skew in expectations was for a more significant taper, perhaps with some justification given the resilience and even further improvement in the European economic performance, despite the stronger EUR this year.

The ECB added some additional dovish elements; it announced that it would continue to reinvest principal repayments on its Asset Purchase Program (APP) “for an extended period of time after the end of its net asset purchases.” And continue its LTRO programs “at least until the end of the last reserve maintenance period of 2019.”

Eurozone equities have rallied strongly on the outcome, retaining a recently revived uptrend, consistent with the underlying strength in the economy, some lift in inflation, and a continuation of the extreme ECB policy accommodation, albeit with a taper in QE.

A key point in the current policy stance remains that interest rates are significantly negative and the ECB has set a guidance that they will stay that way for the foreseeable future. The ECB retains its guidance that, “The Governing Council continues to expect the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases.”

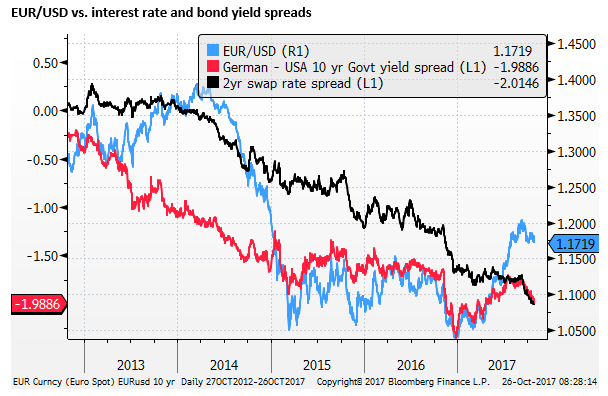

EUR downside risk as focus reverts to wider yield disadvantage

The EUR has been in a rising trend this year despite the ongoing commitment to low rates and slow taper. The market has paid little attention to a widening EUR interest rate disadvantage this year, and widening long-term bond yield disadvantage since mid-year.

EUR structural rebalancing near complete

EUR has paid more attention to the strong European equity market and improving asset performance more generally. It appears to be the case that after two-plus years, from late-2014 until early this year, the market had amassed a structurally under-weight EUR position from both a corporate and fund manager perspective, that drove EUR to a weak historical level.

Investors and corporates have been in the process of unwinding some of that structural underweight position; seeing: the EUR as cheap, more confidence in the sustainability of the Eurozone recovery, much less risk of a break-up it the single currency system, a more stable political environment, and a path back towards normal policy beginning, albeit gradually.

Such longer-term structural positioning adjustment will continue to provide support for the EUR. However, the EUR has adjusted upwards (from 1.05 to above 1.15); after a significant period of time (six to nine months) investors and corporates are likely to have unwound a good deal of their structural underweight position.

Furthermore, short-term speculative/momentum traders appear to have amassed a significantly long EUR position, and the risk is that they will square this up if the EUR loses its upward momentum, which arguably it has, and this correction could be close at hand.

EUR should be historically weak

The ECB retains a very accommodative policy stance; there is an increasing negative carry cost to investors for holding long EUR/USD positions. And a significant positive carry return for foreign investors in European assets if they hedge those assets. There is good reason for the EUR to continue to trade below its long-term historical average in the current environment that is likely to persist for the next year. We may be close to the point where the structural short-covering in EUR is over, and EUR begins to revert to paying more attention to its wider yield disadvantage.

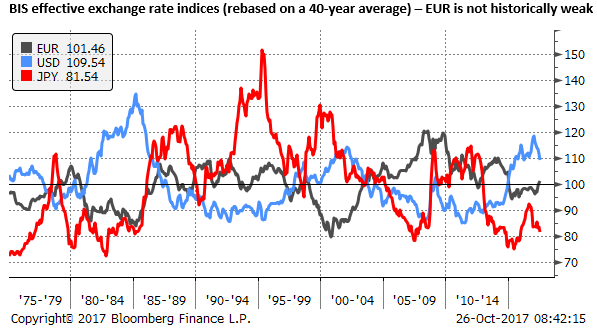

Using the BIS narrow real exchange rate indices, the EUR does not appear to be as cheap as some analysts make out. It is in fact 1.5% above its 40-year average. The JPY is the most clearly stretched from its average at 18.5% below its 40-year average. The USD is moderately expensive at 9.5% above average.

Not shown above is the GBP that Is cheap at 16.5% below its 40-year average. In the dollar-bloc commodity currencies, the NZD is the most expensive at 23% above its 40-year average.

EUR analogous to JPY performance last year

As discussed in our report (EUR and CAD need to square up to growing threats; 18-Oct – AmpGFXcapital.com) we see the EUR rebound this year in many ways analogous to the JPY rebound in 2016. It was a structural adjustment from an extreme oversold condition related to its aggressive QE/NIRP policy. This policy, while moderating, remains extreme, and like the JPY in late 2016 and this year, the EUR will return to a weaker condition; although probably not as weak as was the case in 2015/16.

To be fair, the Eurozone is closer to the returning to a more normal state of policy and ending its QE/NIRP sooner than Japan, and perhaps it can begin a more sustainable upswing at some point, perhaps next year. But much depends on the performance of the US economy and US yields.

EUR traders over-bought

Heading into the ECB meeting, the FX market retained a bullish outlook for the EUR, this may take some time to shake-off, but there appears to be a long speculative position that now needs to be squared off that may take EUR down in coming weeks and months in search of a lower end of its trading range. We see that in the vicinity of 1.10/15.

Bank of Canada go into watch-and-wait mode

The Bank of Canada policy statement on Wednesday walked further down the path started by Governor Poloz in his 27 September speech, where he emphasized data dependence. While the BoC retained its tightening bias, saying, “less monetary policy stimulus will likely be required over time,” it emphasized reasons to wait. It said, the “Governing Council will be cautious in making future adjustments to the policy rate. In particular, the Bank will be guided by incoming data to assess the sensitivity of the economy to interest rates, the evolution of economic capacity, and the dynamics of both wage growth and inflation.”

The Bank’s standard model suggests rate hikes are needed, but all the matters of judgment suggest that hikes are not needed, or at least may not be needed for quite some time.

These include:

- Structural factors at play globally that suggest inflation may remain lower than previous cycles. The MPR has a box on this factor (“The Role of Globalization and Digitization”). It actually tends to downplay them, but still notes them as something that might require a more cautious policy approach.

- Evolution of Capacity. The Bank forecasts that the economy is now operating around its capacity, and that it will move into a positive output gap in the coming year. However, it sees a risk that it is under-estimating growth in capacity. Poloz notes that capacity does tend to grow more than expected in this part of the cycle, and that more rapid business investment will add to capacity.

- Evidence of slack remaining in the labour As in other countries, the Bank can see evidence on broader measures of unemployment and slow wage growth that there may still be slack in the labour market.

- Sensitivity to interest rates. With higher household debt, consumers may be more sensitive to interest rate rises.

Furthermore, the Bank pushed back its timetable for inflation reaching its 2% target from mid-2018 to the second half of 2018, “because of the recent strength in the Canadian dollar.”

The statement also elevated NAFTA as an issue of concern saying it its statement that, “However, this outlook [strong global growth] remains subject to substantial uncertainty about geopolitical developments and fiscal and trade policies, notably the renegotiation of the North American Free Trade Agreement.”

The basic message is that the Bank is now in watch-and-wait mode to assess how all of these matters of judgment play out. It will need the data outcomes to drive the next rate hike. This suggests that the timing of the next hike is much more uncertain, and unlikely before next year.

The odds of a 6-Dec rate hike have fallen from around 50% to 34%. The market retains two further hikes in the curve out to end-2018. Dec-18 3month bill futures implied yield is down 2bp.

There still appears to be scope for Canadian yields to slip further on this statement, especially if you tend to believe the judgment factors will turn out to be more true than not.

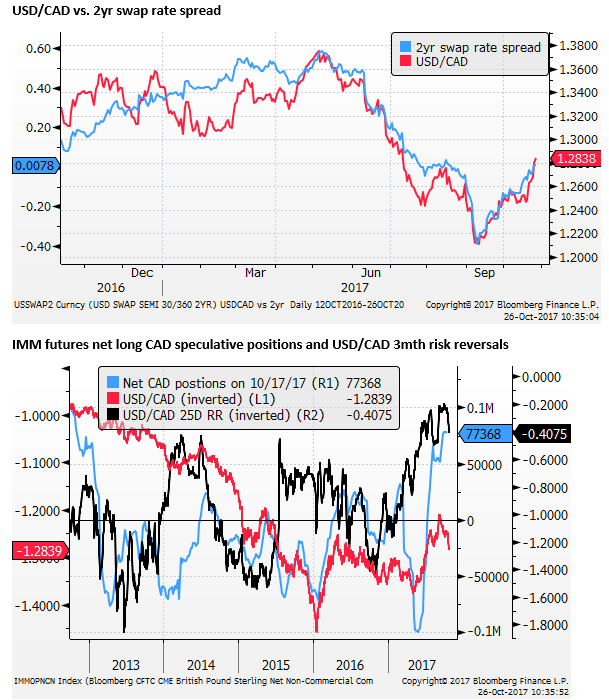

USD/CAD has risen above a previous high at 1.2770; it may be en route to test resistance between 1.2860 to 1.3030, around where it was trading just ahead of the first rate hike in this cycle on 12-July.

Upside risk may also be apparent since CFTC positioning and option skew suggests that the market is well long CAD.

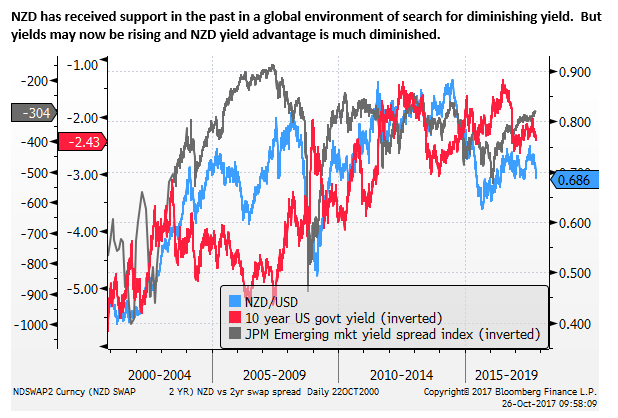

NZ political upheaval a game changer

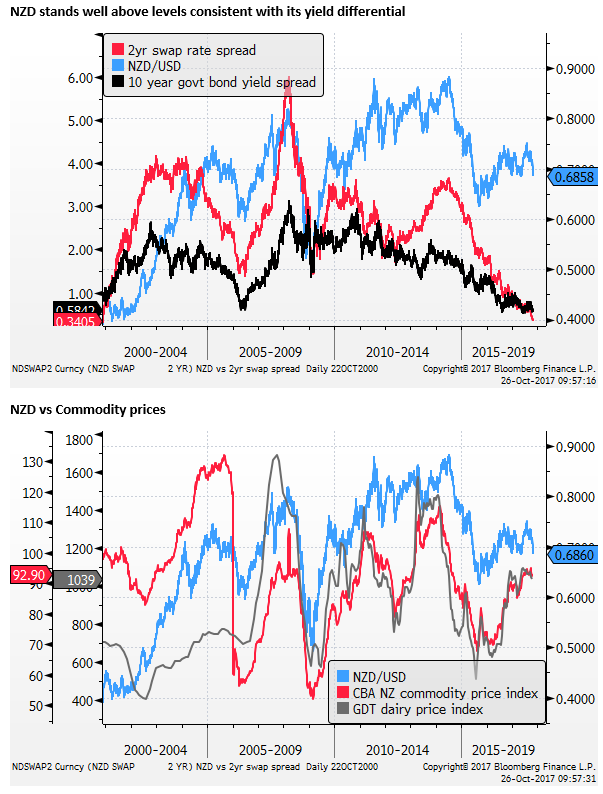

One of the biggest surprise moves in the market in the last week has been the sustained and sudden fall in the NZD since the announcement by king-maker NZ First party leader Winston Peters that he was anointing Labour Party leader Jacinta Ardern to Prime Minister. So far the NZD has shown little bounce, even though it is testing its lows for the year in Apr/May.

This result should not have been a huge shock. Nevertheless, the market reaction has been significant. As we discussed in our report (New Zealand dollar charts a new course; 20-Oct – AmpGFXcapital.com) this event may be a catalyst to shift the NZD into a move sustained negative trend to redress an over-valuation with respect to its long-run historical average and narrowed yield advantage.

There have been reasons for the NZD to be relatively strong over recent years, solid commodity prices, rapid immigration, a construction-led boom and strong housing market. All three were inter-related. However, the housing market had already turned down this year, and stayed down to the surprise of many, including the RBNZ.

Housing affordability and rapid immigration were indeed big election issues and are probably the reason that a business/investor-friendly single-party National Party government that has been extremely successful in steering the economy over the last nine years has been replaced with an un-tested left-leaning Green/Labour/NZ First coalition.

The policies of the new government are more about re-distributing wealth and fairness rather than growing the economy. There does appear to be some significant fiscal stimulus coming down the pike, in part allowed by the strong fiscal position established over the previous government’s watch. And this may well support growth. However, their policies of reducing immigration, cutting back foreign investment, particularly in residential housing, and cutting the tax benefits on housing investment are likely to intensify a housing market down-turn underway.

This may be a deliberate policy action to make housing more affordable. But it is likely to have negative consequences for confidence and economic growth, at least in the near term, and undermine the NZD.

The new government, especially NZ First’s Winston Peters that has secured the Deputy PM and Foreign Minister roles, will gladly welcome a lower exchange rate. As in fact will the RBNZ.

The broader atmospherics are for a significant shake-up in institutions and an approach to government that will tend to increase uncertainty and add a risk premium to the NZD.

In particular, the RBNZ is in for a shake-up; including adding an employment component to its mandate, the selection of a new Governor, and the introduction of a monetary policy board with outside directors. The changes may only be seen putting the RBNZ on the same footing as the RBA, but they are likely to open the door to a more dovish, growth-supporting central bank.

As such, we see NZD making new lows for the year soon, and from a longer term technical perspective, this may open the door for a substantial fall in the currency; perhaps ultimately to new lows since 2009, sub-60s.

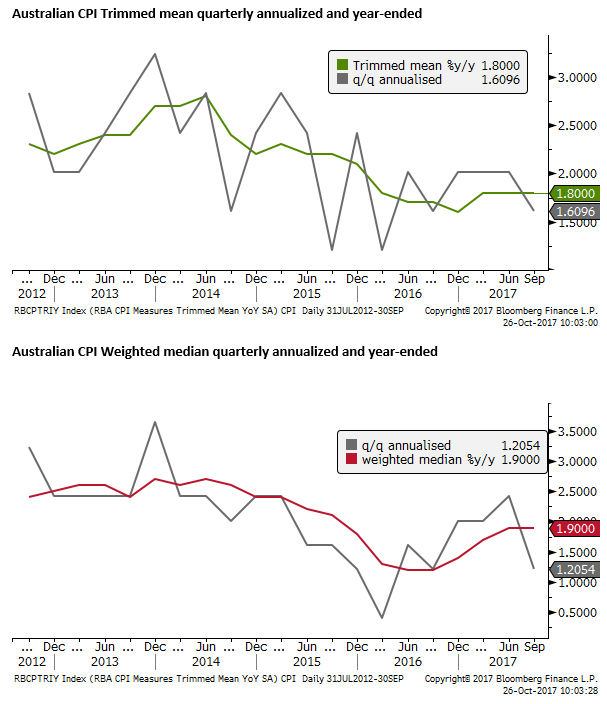

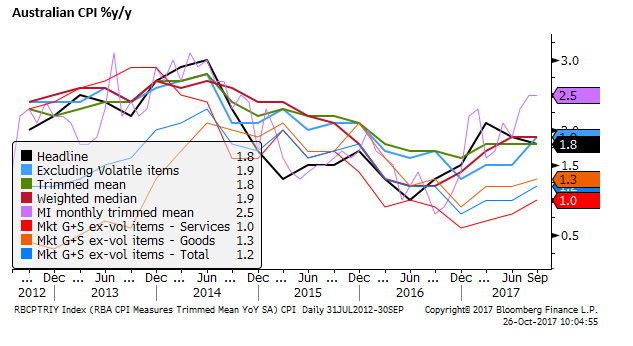

Et Tu AUD

The AUD has fallen sharply with little retracement since its weaker than expected CPI release on Wednesday. It has broken its early-October lows. We see scope for it too to continue to fall. Inflation remains well below the RBA’s target. The Q3 underlying measures were quite a bit softer than expected (charts below).

The RBA’s preferred exclusion measures (Market goods and services less volatile items are far below their 2 to 3% target range (chart below).

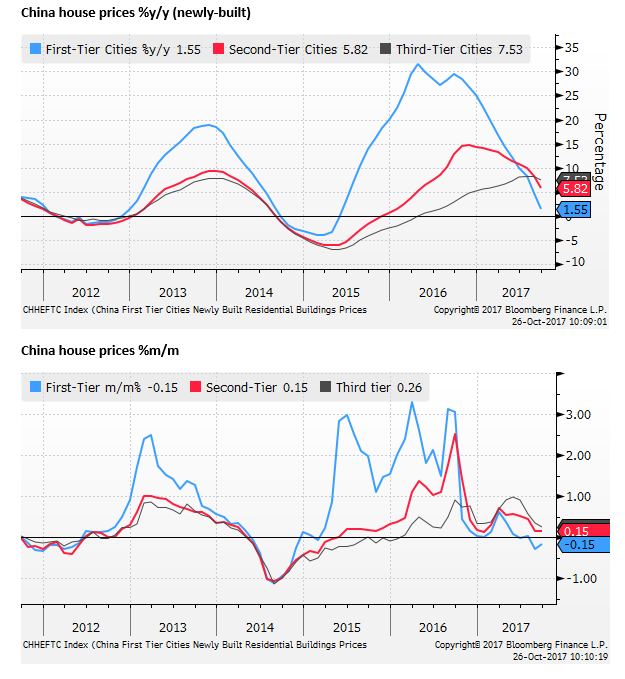

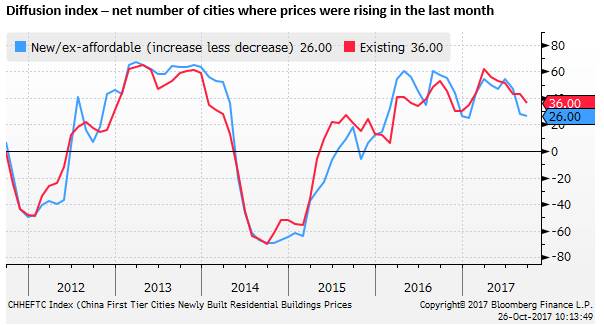

The Australian housing market now appears to be slowing, reflecting lower foreign demand, tighter macroprudential measures, affordability concerns and increased supply in major cities.

The Chinese property market is also slowing down, and China may also move to a less growth-supportive policy in the year ahead now that it is past its 19th Congress.