Time to think about selling CAD and AUD

We have been observing more than participating in choppy FX markets over most of this month, unconvinced that a weaker USD would persist, but accepting a period of weakness might unfold as US rate hike expectations were whittled down and some correction may have been required after the steady build-up to the first rate hike in December. However, we have favored a long gold position and continue to see potential for gains, more so against EUR and JPY. We now wonder if the market has turned away from the risk of rate hikes in the US too much, and see commodity currencies like CAD and AUD beginning to stretch too far to the strong side. We see greater risks of a prolonged period of subtrend economic growth in Canada, and too much positive spin placed on a modest fiscal expansion, when unemployment is still trending higher and pressure on the energy sector is likely to remain intense. In Australia, capital expenditure, wages and employment data were all weaker than expected. The housing market may also be losing momentum especially as government policy may become more responsive to the public’s affordability concerns (willing to reduce tax concessions on property investment) and banks face greater scrutiny on mortgage lending practices.

US activity mixed, but inflation pressure may emerge

I wrote earlier in the week to be wary that US inflation may be creeping up when everyone seems to least expect it. (AmpGFX – Is inflation rearing its head when least expected?, 22-Feb). In contrast to falling and record low long term inflation expectations in the US and globally, US core inflation is trending gradually higher. The CPI report last week may be emulated in the PCE on Friday. This is important when most of the market has given up on US rate hikes for the foreseeable future.

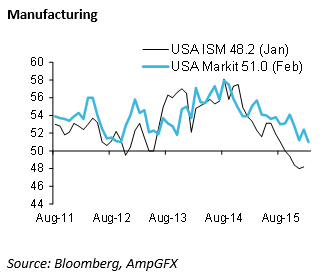

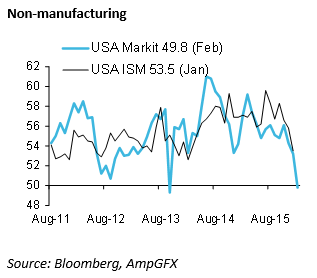

Otherwise the US economy is sending off mixed signals. The housing market is still showing moderate strength. However, manufacturing surveys still look depressed around their weakest point in the long recovery since 2009. The weakness in the energy sector continues to drag on these surveys. Weak global trade also appears to be a dampening factor in the US and globally.

The market took fright last month when the ISM non-manufacturing index fell to 53.5 in January, down sharply from 55.8 in Dec, after averaging around 57 since mid-2014. This damaged the narrative that the larger services sector of the economy was resilient underpinned by consumer demand, solid employment growth and lower energy costs.

Of concern is that the Markit PMI service sector flash reading dropping sharply from 53.2 to 49.8 in February, sliding into net declining growth territory (sub-50). The ISM reading is regarded as more reliable, but the concern is that the ISM follows the Markit PMI.

The further slump in the Markit PMI was blamed by Markit economists on the severe winter storm (Jonas) That hit in late January and disrupted business in early-Feb. The Markit PMI may also be more influenced by sentiment than current activity, and global market upheaval at that time might have dragged down this result. The ISM non-manufacturing report due on 3 March may be more stable.

The most recent jobless claims data send a different story. The 4-week moving average of claims has fallen back to 272, the low since mid-December, reversing the rise in January to 285; suggesting the labour market still remains relatively tight.

Durable Goods core capital orders rebounded in January from a sharp dip in December, alleviating fears to some extent over weakening economy. Orders remain flat over the last year, and below the peak in Q3-2014.

The outlook for the US economy remains clouded. There is evidence of slowing, but it still may be growing fast enough to keep unemployment falling and the economy may now be close enough to having used up spare capacity in the labour market to keep wage growth rising. Combined with rising housing costs and a steady recovery in the housing market, the recovery in inflation may appear more sustainable. In which case US interest rates may appear more likely to follow an upward trajectory than most other economies and return support to the USD.

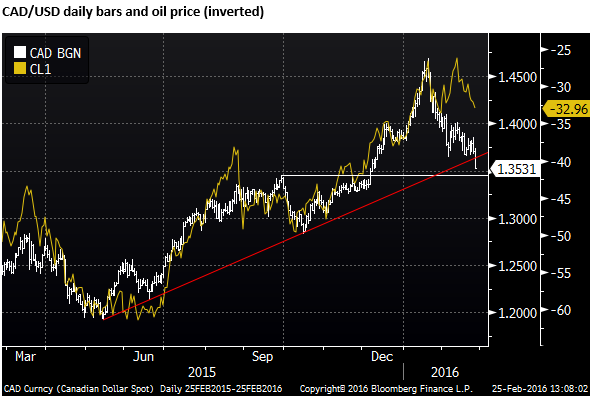

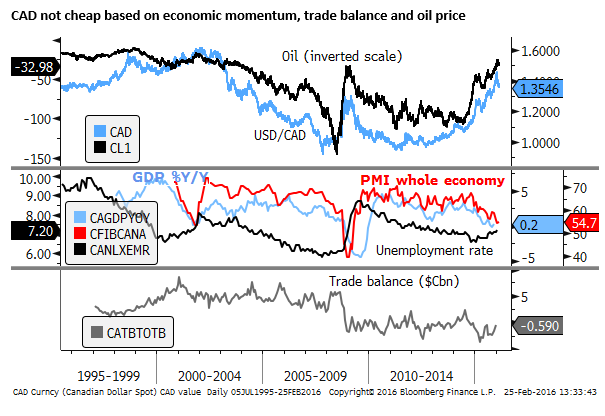

USD/CAD may have swung too far lower

It is interesting to see USD/CAD drop back to near 1.35, fully reversing a surge in the currency from early December to a high near 1.47. A key turning point for the currency was the decision by the BoC not to cut rates in January (AmpGFX – Bank of Canada decides to Grin and Bear it, 21 Jan). It was concerned at the time of triggering an even more rapid slide in the CAD that might cause a rise in inflation expectations. BoC Poloz also said he wanted to see what type and amount of fiscal stimulus the new Trudaeu led Liberal government might implement.

Oil prices bounced back at the same time of the January BoC policy meeting on the first talk of possible cooperation between Russia and Saudi Arabia to control oil supply. However, as the chart below illustrates, the CAD has bounced back considerably more than is explained by oil prices (based on its recent relationship)

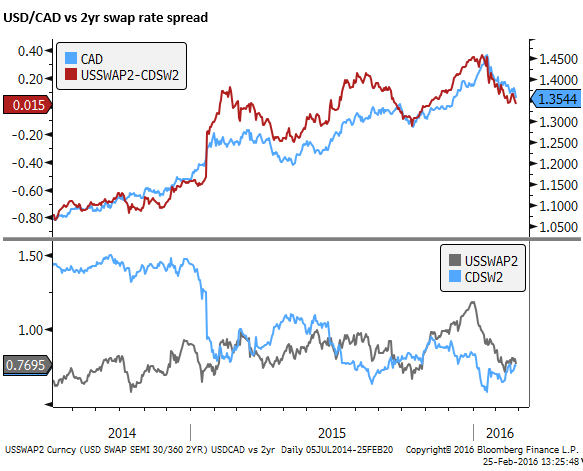

The additional strength in the CAD relates in part to a weaker USD that has been undermined by weaker US data and lower US inflation expectations, causing US rate hike expectations to fall significantly and a correction in the excessively bullish USD viewpoint established in the lead-up to its first rate hike in December.

In recent sessions the new Government of Canada has lived up to expectations that it would provide significant fiscal support for the economy. The finance minister Bill Morneau has estimated the budget deficit will be closer to $C30bn (above an election pledge to cap it at $C10bn).

After the BoC Governor Poloz said he was waiting for the 22 March budget for clarity on fiscal policy this appears to make a rate cut much less likely, and the market pricing of a cut has diminished significantly since the January policy meeting. This is despite US rates also falling since this time, resulting in a significant narrowing in the USD/CAD yield advantage.

However, while there have been a number of developments that account for a stronger CAD, one must wonder now if the market has been largely squeezed out of its bearish CAD positions, and the currency has swung too far the other way.

The bottom line is that much of the government’s budget deficit increase is a result of weaker revenue, not more spending, a function of a weaker economy and weaker terms of trade. Oil prices have stabilized, but they remain relatively weak, and pressure on the energy sector is likely to persist. Recent economic data suggest that the risks are higher that the economy continues to grow below trend for the foreseeable future. The strength in the CAD may be sufficient for the BoC to speak more dovishly on 9 March.

AUD strength also seems unjustified

There have been similar rebounds in other commodity currencies. The AUD/USD is also starting to break the will of the bears. It might need one last push higher (like the CAD appears to have done) to force out short positions.

The rising AUD/USD has some of the same characteristics as the CAD, both have been supported by a recovery in commodity prices in the last month and a weaker USD. THE RBA has also offered a less dovish view than many market participants thought it might over recent months.

However, more recently it appears that the domestic economic risks are rising in Australia. The improvement in the unemployment rate stalled, rising back from 5.8% to 6.0%. The wage cost index fell to a new record low growth rate, seeming to support the notion of continuing slack in the labour market and risk that inflation falls more persistently below the 2% target rate (underlying inflation is already at the bottom of the 2 to 3% target band).

The capital expenditure survey again deteriorated, continuing for over a year to disappoint RBA hopes of a pickup outside of the mining sector that is in contraction. The housing market remains resilient but also may be peaking.

Political risks are rising as the government discusses tightening expenditure and considers policy that may reduce some tax concessions on the property market. An early election may be brewing. The housing market has returned to the foreground as a potential flashpoint for the Australian economy as we have discussed in our recent reports.

AmpGFX – Jobs data take some wind out of the RBA’s sails, 19 Feb

AmpGFX – Australian government tinkering with a ticking time-bomb, 18 Feb

AmpGFX – Housing becomes political as election looms in Australia, 24 Feb