Trump’s ‘reality show’ hurts the dollar, Euro and UK look perky

After a tepid start to the week on Monday, where US bond markets were closed for Colombus Day, the USD has fallen significantly on Tuesday. Asian currencies led the fall, enthusiastically followed by developed market currencies, including EUR and GBP. Political uncertainty continues to undermine the USD. Trump’s battles with Senator Corker, the NFL, North Korea, Iran, the media, and Democrats over ‘Dreamers’ creates a sense of chaos that dampens prospects for tax reform. Global economic recovery continues to support global equity markets, and investors are more willing to take EM currency exposure to avoid elevated political risk in the USA. EM currencies have lagged a rebound in EM equities in the last two weeks and started to play catch-up on Tuesday. Strong German factory orders, industrial production, and exports support the EUR. Sentix Eurozone investor confidence also rose to a new high and Spanish separatist threats have eased. A global economic recovery is dragging the UK along for the ride, increasing the likelihood of BoE rate hikes. UK political risk may now ease from elevated levels.

Germany maintains strong momentum

Germany has delivered a trio of strong industrial data showing strength in domestic and export markets. On Friday, factory orders rose 3.6%m/m in Aug, up 7.8%y/y. On a three-month moving average basis, they rose 6.1% from a year earlier, a high rate since 2014.

Domestic orders rose 2.7%m/m in Aug and 6.3% 3mth/yoy, a high since 2011. Foreign orders rose 4.3%m/m in Aug and 6.0% 3mth/yoy, a high since Jun-2015.

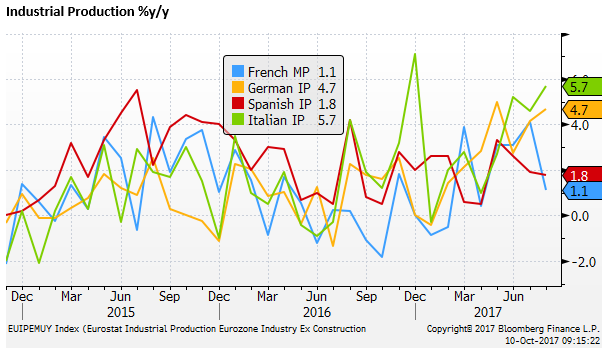

On Monday, German industrial production was reported to have risen 2.6%m/m in Aug, above 0.9% expected, up 4.7%y/y; around the high since 2014.

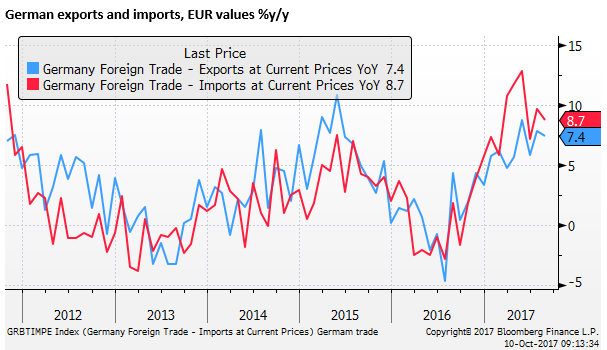

On Tuesday, German exports were reported to have risen 3.1%m/m in Aug, rebounding from softer readings in the previous two months, above 1.1% expected. They rose 7.4%y/y in Aug; around the high since mid-2015. Imports rose 1.2%y/y, up 8.7%y/y.

French industrial production fell 0.3%m/m in August, up 1.1%y/y, below 1.5% expected. However, Italian industrial production rose 5.7%y/y in Aug, well above 2.9% expected. Eurozone IP is due on 12-Oct.

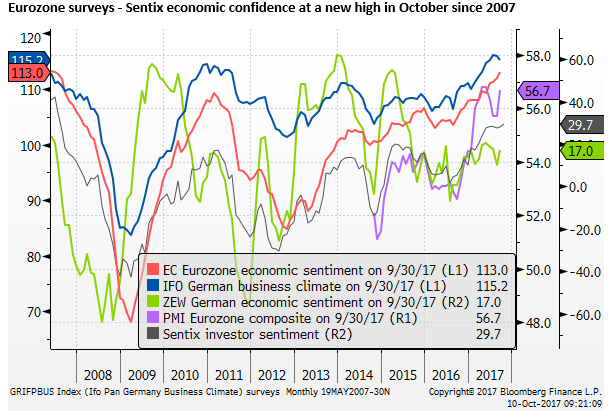

On Monday, the Sentix investor survey of Eurozone economic confidence firmed to 29.7 in October, above 28.5 expected, a new high since 2007. Other survey data, the latest for September, point to activity retaining strong momentum.

UK growth momentum likely to embolden BoE to hike

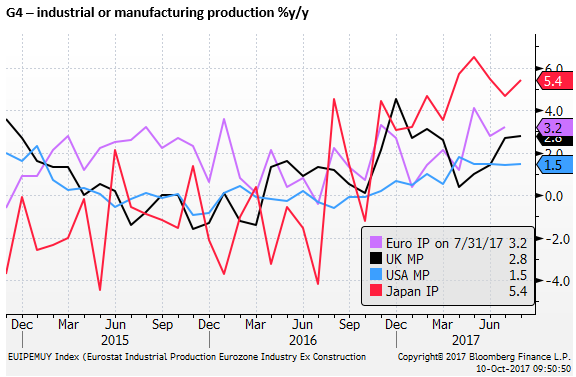

UK manufacturing production rose 2.8%y/y in August, above 1.9%y/y expected, and it was revised up from 1.9%y/y in July, to 2.7%y/y. The strength in global growth is helping underpin the UK economy, despite Brexit uncertainty. In the G4 major economies, the US manufacturing has grown the least at 1.5%y/y in August.

UK construction output rose 3.5% y/y in August, above 0.2% expected, and revised up to 2.7%y/y in Aug from -0.4%, significantly improving the trend from declining growth to at least modest growth from a year earlier.

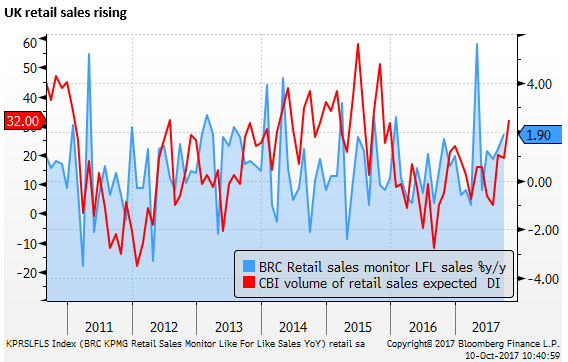

BRC like-for-like retail sales rose 1.9%y/y in September, reported on Monday. These data tend to be volatile, but on a six-month moving average basis (up 1.75%) they are at a high since 2010. The BRC spokesperson said, “much of the growth is being driven by price increases.”

The pick-up in BRC retail sales is consistent with the CBI retail diffusion index of the volume of sales that rebounded from -10 in Aug to +42 in Sep; reported on 27-Sep. The outlook for sales volume rose from 19 to 23 in October, a two year high.

The UK Office for National Statistics revised up unit labour costs in the first half of the year significantly; to 3.5%y/y in Q1 (from 2.1), and to 2.4%y/y in Q2 (revised up from 1.6%).

This reflects weaker productivity growth, consistent with the BoE view that even though growth in activity is moderate, it is bumping up against capacity and weak growth in potential output, raising the odds that it will need to remove policy accommodation to address above-target inflation, despite Brexit uncertainty.

The latest UK data suggest that the BoE will proceed to remove its rate cut enacted in August last year after the Brexit vote at its next MPC meeting on 2 November. Their inflation report and policy statement will point to further rate rises, albeit gradual and limited.

The market currently has 79% probability of a 25bp hike on 2 November, and 53bp of hikes priced into the OIS curve by the end of next year. As such, it is somewhat prepared for hikes, but there is scope for further increases in UK rates and yields in coming weeks.

Elevated political risk in the UK may now ease

Political uncertainty has dogged the GBP in recent weeks, with the leadership of PM May under pressure into and during the Conservative Party conference last week. Brexit negotiations continue to be bogged down over the divorce bill, preventing progress on the crucial issue of a trading relationship and transition period post-Brexit.

On Friday, according to European diplomats, a German-led group of EU countries has demanded more clarity on the long-term financial commitments Britain will honour. (source FT)

Germany rejects Theresa May’s Brexit transition hopes – FT.com

Understandably, the UK does not want to give up further ground on what it is prepared to pay without gaining a clearer understanding of future trading arrangements and a transition period.

In the meantime, business leaders in the UK are getting impatient with the lack of progress in Brexit talks. Several bank execs have said staff outflows will accelerate if a transition deal is not taking shape by Q1 next year.

Howard Davies, chairman of Royal Bank of Scotland, warned that the government had only six months to secure a transition deal. If there was no deal by March, companies, including RBS, would start to move jobs to other parts of the EU, Sir Howard told Sky News. (source FT)

EU rejects Theresa May’s call to advance Brexit talks – FT.com

UBS to shift staff if no Brexit transition deal by March – FT.com

Nevertheless, there may be scope for political and related Brexit uncertainty in the UK to ease from recent elevated levels.

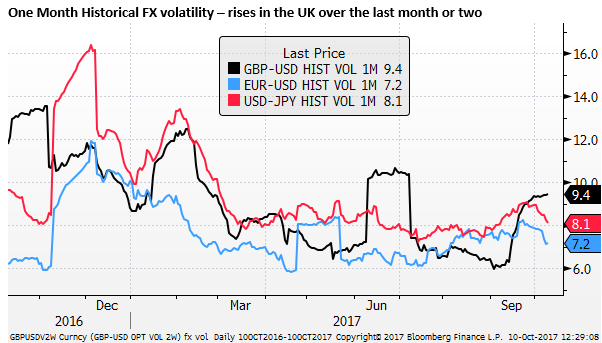

Options markets priced for greater GBP volatility and downside risk

GBP volatility has picked up in the last month due to rate hike speculation, political uncertainty, and slow progress in Brexit negotiations. One-month historical volatility (annualized standard deviation of daily log changes over the last month) rose significantly above that for EUR and JPY.

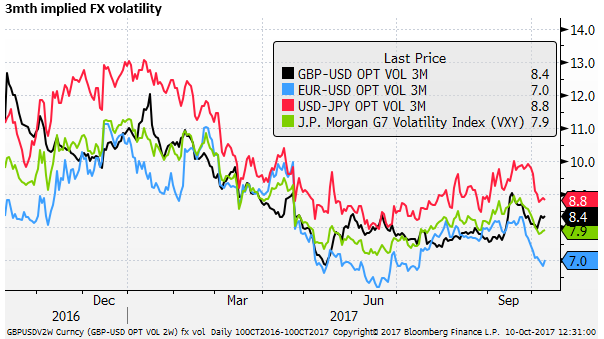

3mth implied GBP/USD vol (expected vol implied from the options market) has also climbed relative to its peers.

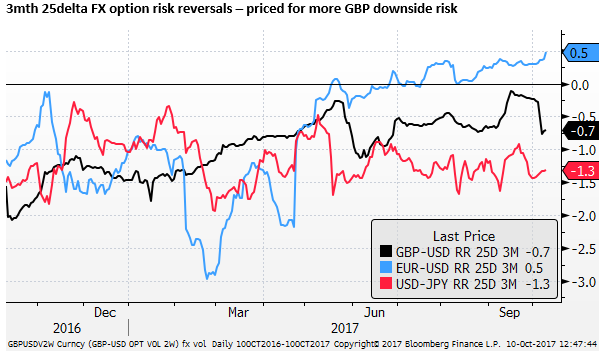

The skew in the options market (the price of calls vs. puts) for 25 delta 3mth options has fallen in the last week for GBP/USD. The market is willing to pay more for downside protection; implying that it sees the risk of a large downside move in GBP as more probable than a large upside move.

In contrast, the risk reversal has risen to a more positive level for EUR/USD; suggesting that the market sees more upside risk for the EUR (notwithstanding recent political uncertainty in Spain).

One interpretation of these option market developments is that the market has built in more political risk for the GBP in the last week or so, and there may be scope for the GBP to rise if this risk fades.

Any progress on Brexit negotiations is likely to be viewed favourably. UK PM May may have seen off potential challengers for the time being. The longer she can prevail, the more it may seem her position is stable.

If political and Brexit news ebbs, the market may focus more on the prospect for rate rises which is likely to support the GBP.

Trump chaos continues

The USD has started this week on the back-foot, weakening significantly against emerging market currencies and more broadly. As discussed yesterday, we see potential for the USD to rise into year-end based on higher yields, inflation risks, and what may be an excessive broad-based net short speculative position.

Skeptical market is very short US dollars; 10 Oct – ampGFXcapital.com

The dollar has made a habit of year-end rallies; 4 Oct – ampGFXcapital.com

However political uncertainty appears to have increased again over the last week. Much of it related to Trump’s tweets on various issues that appear to undermine cooperation with Congress on tax reform both with his own party and Democrats, reinforce broader social division, and raise fears of conflict with North Korea.

Trump and now his VP Pence have continued attacks on NFL players that choose to kneel during the national anthem as a protest against the social injustice they see in their country. Trump’s intolerance for their position appeals to his ‘Alt-Right’ supporters, fuels social division, and distracts the public and political debate away from tax policy. The President continues to appear more interested in promoting his vision of nationalism than economic reform.

He has continued to bait North Korea and threaten military action, saying “only one thing will work!” And appears to be working at odds with his Secretary of State Tillerson.

The twitter barrage at Senator Bob Corker, a more frequent critic of Trump, appears to demonstrate that Trump is more interested in personal point scoring over building consensus for tax reform.

Bob Corker Says Trump’s Recklessness Threatens ‘World War III’ – NYTimes.com

Republicans to Trump and Corker: Please just stop – politico.com

On Sunday, Trump also said that any deal for legal status for the DACA ‘Dreamers’ will have to be part of a broader deal that covers his policies on a border wall, action against sanctuary cities, border security and immigration. This appears to undermine the goodwill he garnered with Democrats by suggesting some weeks ago that he would work with them to pass a Dreamer Bill.

Trump defends immigration demands while criticizing Dems on border security – politico.com

It is hard to say if these side issues have any implication for the progress on tax reform, but they continue to fuel the impression of a president that is easily distracted and willing to risk tax reform or conflict with North Korea to defend his image.

He continues to divide national opinion and generate a sense of chaos. In this environment, it is hard for the market to see Congress coming together to pass meaningful tax reform.

Senator Corker’s more intense criticism of Trump has illustrated how thin-skinned the President is. Corker has voiced the fears of many in the market; that Trump runs his office like “a reality show” and could set the nation “on the path to World War III”. Trump’s response only reinforces this impression.

The US Stock market continues its remarkably low volatile grind higher. Trump frequently proclaims that this is because of his leadership. However, investors appear to be pursuing investments in emerging markets and Europe with at least equal vigour and taking the local currency exposure to avoid US political risk.