USD Shrugging-Off Political Risk, AUD Headwinds and EUR Cracks

The USD has managed to shake-off increased political risk, although this remains a threat. The prospect of a more upbeat FOMC may be supporting the USD. The market is looking for some upward revision to the dot-plot. Eurozone confidence and inflation expectations have eased. EUR yield spreads deteriorate to new lows. AUD may have been undermined by weaker metals prices and risks to Chinese growth; including from the US protectionist threats. The Australian employment report this week and improving prospects for corporate tax cuts may help support the AUD, but the Royal Commission into Misconduct in the Banking, and Financial Services Industry, and slowing housing market may be undermining investor demand for the AUD.

USD Shaking off Political Risk

The USD has performed solidly in the face of more intense political uncertainty since the weekend. Already, last week, it was tending to strengthen despite a poor showing by Republicans in the 18th District Pennsylvania special election and staff turnover at the White House.

The ongoing noise around the Trump tariffs and worries over a trade war also appeared to have had less negative impact on the USD in the last week, but instead may have dampened the performance of emerging market assets and currencies, and perhaps also weighing on the EUR somewhat.

After the McCabe firing over the weekend, comments from the President and his legal team aimed at discrediting the Mueller investigation, and claims of ‘deep state’ conspiracies, we feared a fallout for the USD. News related the Mueller investigation has appeared to weaken the USD at times over the last year. However, there has been little negative fallout for the USD so far this week.

Perhaps the USD’s strength is coming from the anticipation of the FOMC meeting on Wednesday. If so, its continued strength into end week may rely on the Fed delivering at least some sign of a lift in the probable path for rates. However, it does appear that the USD is demonstrating a more solid footing.

Nevertheless, it still faces significant political headwinds as the mid-term elections draw nearer and the noise around the Mueller investigation picks-up.

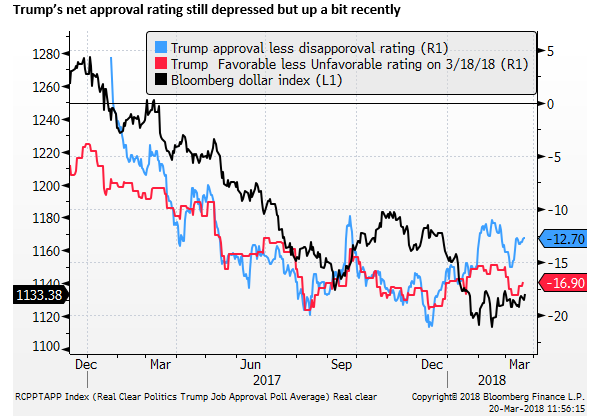

Trumps net disapproval rating in a Real Clear Politics index, based on a range of polls, remains significantly net negative, well down over the 15 months of the Trump Presidency. However, it has improved somewhat since the tax cuts were passed and may have been lifted a bit by the Tariff/trade protectionist rhetoric.

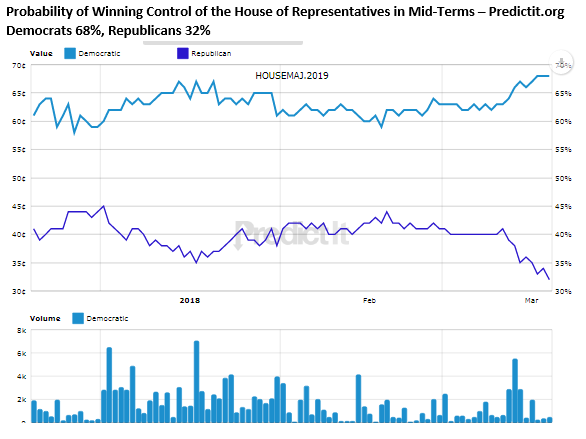

This improvement has not been enough to lift the probability that Republicans can retain control of House of Representatives after the November mid-terms. This has deteriorated in the wake of the P18 election.

A House controlled by the Democrats greatly increases the risk that impeachment proceedings are brought against the President if the Mueller investigation finds enough evidence to suggest that Trump obstructed justice or colluded with Russian actors in their efforts to swing the 2016 election in his favour.

Trump’s actions suggest he would not take this lying down and would intensify attacks on the Clintons, Obama and their supporters, including claiming bias in key government agencies. The risk of this all becoming a major distraction for government and public discourse into and after the November mid-terms remains high and still threatened to undermine the USD.

US Political Risk Threatening the USD and More; 15-March – AmpGFXcapital.com

Nevertheless, the USD is proving more resilient to the latest spike in political uncertainty, and it might be able to continue to shake-off political risk in the near term.

Just ahead of the tariff news on 1 March, the USD was showing signs of breaking higher, reaching its high point since mid-Jan, breaking briefly above a down-trend wedge after making a double-bottom. Notably, this occurred just after the more hawkish Powell Testimony to Congress.

USD tests resistance after double bottom; 28-Feb – AmpGFXcapital.com

The turmoil that followed the tariff announcement appeared to weaken the USD initially, even though you could have argued it might support the USD particularly against EM currencies and even the EUR.

After a choppy period over March-to-date, the USD again appears to be creeping up to test key resistance levels on broad indices.

FOMC dot-plot and Powell under the spotlight

The FOMC meeting may be crucial for the next leg for the USD. The market will be intently watching the first press conference by new Fed Chair Powell. He will face tough questioning on the tariff/protectionist policies of the Trump administration.

Will he dare to openly criticize the Trump administration as several other nation’s central bankers have? Will he admit they add a significant element of risk to the global and US economic outlook? Will he say they add some upside risk for inflation in the USA? One would assume he will be much more cautious in his comments and tend to downplay their impact on the Fed’s outlook.

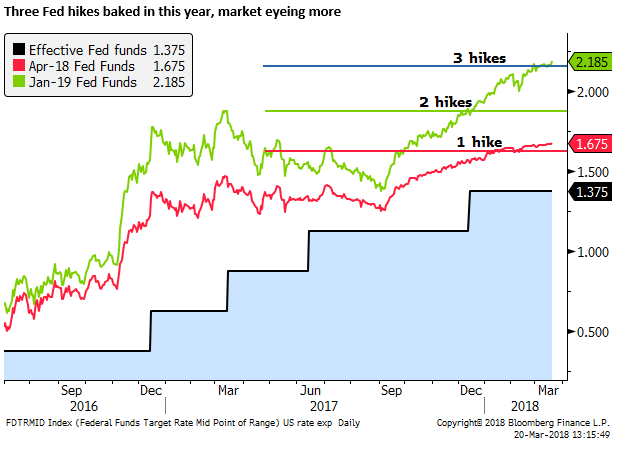

A rate hike is fully priced-in, what matters for the market is the outlook for further rate hikes. At this stage, the market has essentially fully priced in three hikes this year, right on the Fed’s December dot-plot median.

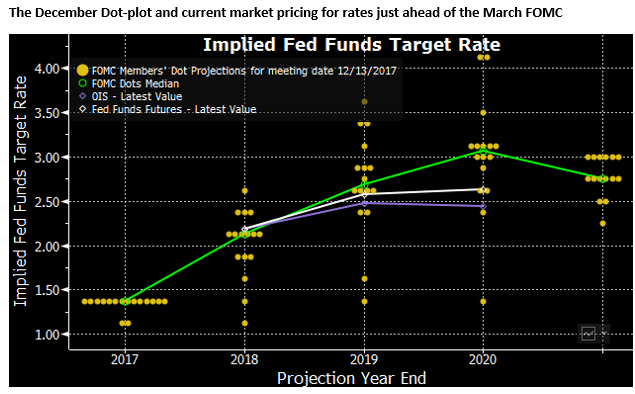

Judging by market commentary, the market expects to see some increases in the dot-plot, proposing an increased probability of a fourth hike this year, and more beyond. The chart from Bloomberg below shows that the Fed is already projecting rates to rise by around another 100bp beyond this year over the next two years to peak around 3.1%, before falling back in the long run to around to 2.75%.

Of particular interest for the bond market may be the long run neutral policy rate (currently seen at around 2.75%). This rate has more often been revised down over the last several years, suggesting that the Fed had become more pessimistic over the long-run growth potential for the USA economy.

Any significant increase in this neutral rate might be taken as a vote of confidence in the Trump tax cuts. For example, the Fed may see the tax cuts as boosting the investment outlook in the US, boosting the potential growth rate.

If the Fed raises this long-run neutral rate, it might reinforce market optimism towards the US economy, and trigger another leg up in US bond yields. This could provide impetus to gains in the USD.

A rise in the long run neutral rate is more likely than not to be accompanied with some increases in the overall dot-plot for rates.

What’s up (and down) with the AUD?

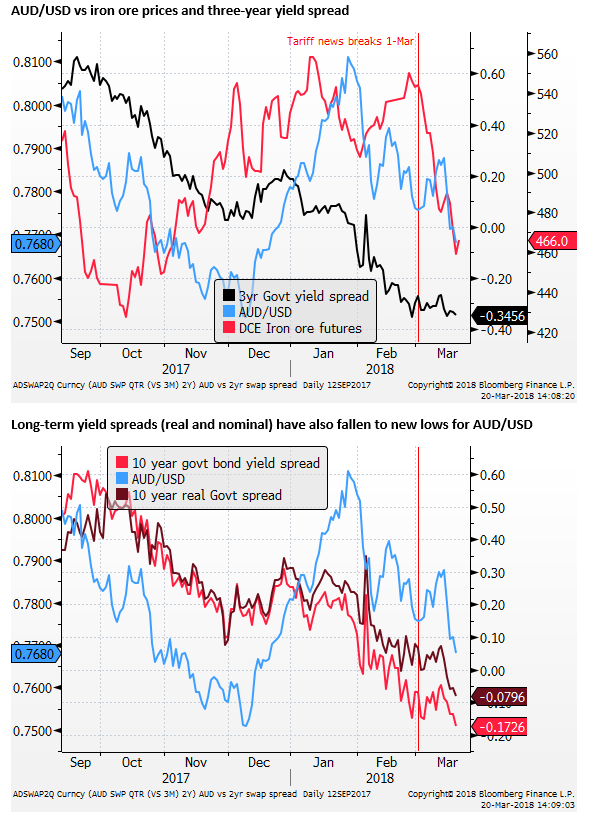

The AUD has been one of the weaker currencies in recent sessions. We had thought that the AUD might come under pressure after the tariff news come out in early-March. We thought as a major exporter of steel-making commodities to Asia, it had as much to lose from steel tariffs as any country. Further, we thought that since US protectionist policy was chiefly aimed at China, AUD might be seen as a proxy for increased economic risk for China and the global economy.

EUR and AUD risks ignored for how long? 6-March – AmpGFXcapital.com

Trump vs. free trade orthodoxy; 8-March – AmpGFXcapital.com

Perhaps belatedly, after initially rising in early-March, the AUD is now responding to the risks from tariffs to growth in China and global growth. Chinese iron ore futures prices have fallen significantly since the tariff news.

China property market a risk for AUD

A number of economic reports in China have started the year on a strong note. However, a good part of the recent economic strength in China appears to have been supported by strong export growth. As such, increased USA protectionism directed at China represents a significant risk for economic confidence in China.

Recent data suggest that the Chinese property market is weakening, a key user of steel. This may also be spilling over to weaker steel-making commodity prices and the AUD.

The RBA was upbeat on its outlook for global and trading partner growth in their policy minutes released on Tuesday. But they made some comments that suggest there are risks towards slower growth in China.

They said, “In China, growth in total social financing had slowed in recent months, with a significant switch from non-credit to bank-based financing early in 2018. This suggested the Chinese Government’s policy efforts to contain financial risks were having some effect. Policy efforts to restrain the housing market also appeared to have had an effect, with housing price growth having slowed, especially in the larger cities. The authorities had announced a target for output growth in 2018 of around 6½ per cent, which was lower than the published rate of growth for 2017 of 6.9 per cent.”

Minutes of the Monetary Policy Meeting of the Reserve Bank Board – RBA.gov.au

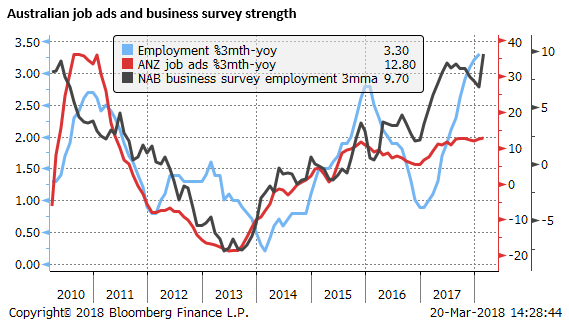

Watch out for strong Australian employment report

Recent Australian economic data point to above-trend growth with booming business confidence and strong employment indicators. A strong employment report should be expected on Thursday this week. This might tend to support the AUD.

The AUD might also draw some strength from signs that the government might be able to gain enough support from Senators on the cross-bench to pass its proposed corporate tax cuts.

Pauline Hanson, Derryn Hinch want higher wages for company tax cuts – AFR.com

Banks and home lending under the microscope

On the other hand, working against the AUD is the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry that is placing a spotlight on lax mortgage lending practices in Australia. Banks are likely to see the writing on the wall that they will need to apply more strict lending conditions in future.

A fresh round of home loan curbs is coming: UBS; 19-Mar – AFR.com

The housing market in Australia is slowing in the major cities, and this may be seen as delaying future RBA rate hikes that are already seen as unlikely this year. The intense pressure on banks coming from the Royal Commission may be seen as extending the slowdown in the housing market.

A federal election due early next year is also likely to be seen as a downside risk for the housing market as the opposition Labor Party is ahead in the polls and is proposing removing tax deductions related to property investment.

Is Labor’s negative gearing policy another reason not to buy property? 8-Jan – AFR.com

Positive Plan to Help Housing Affordability – ALP.org.au

The RBA made the following observations on the housing market in their policy minutes released on Tuesday: “Members noted that conditions in the established housing market had continued to ease in recent months. This had been most evident in Sydney, where housing prices had continued to decline across most segments of the market. Housing price growth had clearly slowed in Melbourne, and this had been most apparent in the more expensive parts of the market. Auction clearance rates had declined to around average levels in both cities.”

Eurozone confidence wanes

EUR, so far, is holding near its highs, but has lost some altitude. A Reuter’s article citing ECB sources helped support the EUR somewhat suggesting that the ECB was likely to end its QE purchases this year. But this is probably largely priced-in. The article also emphasized that the debate has turned to the pace of rate hikes. This is all consistent with the speech by President Draghi last week, highlighting risks from a high EUR and trade protectionist threats. Both of which may delay future rate hikes.

ECB debate shifting to interest rate path from QE: sources – Reuters.com

Monetary Policy in the Euro Area; Speech by Mario Draghi; 14 Mar – ECB.Europa.eu

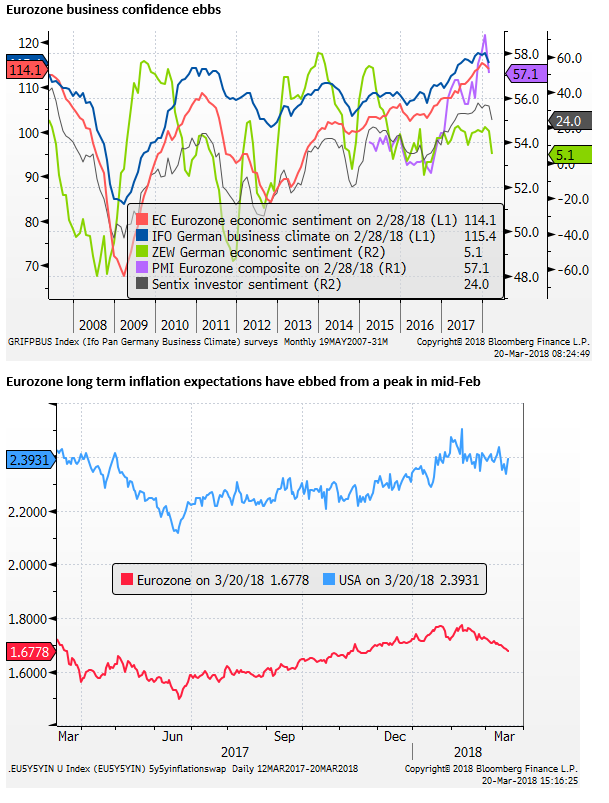

The recent data shows confidence has ebbed in the Eurozone. The ZEW outlook survey has fallen, it seems dampened in part by US protectionist policies.