TRL for USD; exchanging one twin deficit and populist government for another

Safe haven demand is strong for the USD with alternatives gold, JPY and bitcoin missing in action. This may be helping drive the USD higher in the recent upheaval led by Turkey. And it may be adding to the woes of other EM currencies with significant dollar-debt. However, when you exchange TRL for USD, you are exchanging the currency of one country with a large twin deficit for another with an equally troubling demand for dollar debt. You are exchanging a populist political leader with a penchant for controlling the media and the central bank for another in an existential battle with the political and legal establishment, attacking the media, central bank and many foreign countries’ governments. The US economy is not an island immune from risks abroad, and it is not well prepared to deal with an economic slowdown or financial stress. There is no fiscal room, and all eyes would turn to the Fed if, and when, stress abroad, some of it driven by US foreign policy, feeds back to the USA.

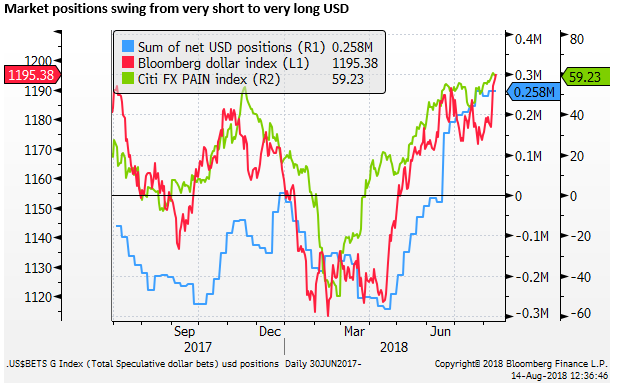

A fickle market is all-in on the dollar

The market appears all-in on a strong USD view. It may not have strapped the position on fully yet, but the sentiment swing is almost complete. The reason? – higher and rising interest rates fueled by fiscal expansion.

Ahem…., the fiscal expansion was in the planning from the day Trump was elected in November 2016, coming to fruition in Q3-2017 and enacted by end-2017, and yet the USD was nose-diving up to late-January 2018. The US hiked rates three times in 2016 and has targeted a steady pace of hikes throughout this year (and next) for more than two years. This is not new information.

These are good reasons to support the USD, but the market failed to react to the obvious last year, instead, it was convinced that US interest rates didn’t matter anymore. It seemed they were already largely priced-in.

Earlier this year, there were many commentators instead fixated by the rising US twin deficits, and they much preferred the negative-yielding EUR with its current account surplus and improving and relatively solid fiscal position. It was trading comfortably nearer 1.25 up until April this year, and plenty of experts were advising clients it was cheap, en route to 1.35 in the coming year.

The US economy stands taller in a fading global economy

OK to be fair, the tide turned towards the USD as the oft-cited synchronised global growth story of 2017 faded this year, and now the US economy stands taller again. Not that you should be surprised as the USA is the only economy enacting a late-cycle fiscal expansion.

The external outlook has been hampered by things such as US trade policy, higher USD borrowing costs, credit-tightening in China, and political misadventures in several countries.

Many of these factors also work to undermine confidence in the US economy, but its fiscal expansion has kept at bay negative thoughts. The market has come to see, at least for the moment, that tough US trade policy hurts others more than the USA, just as Trump said it would. (Trump has said many times a trade war is easy to win)

US Trade policy supports the USD

The point has been made that the market lacks consistency. But to drive it home, Trump has been talking tough on trade since early in his Presidency, pulling out of a TPP deal within days of his inauguration, threating to tear up NAFTA and deal with China and other trade imbalances through his election campaign.

Even when he announced steel and aluminum tariffs in March, there was plenty of analysis on the street explaining how this would be negative for the US economy and the USD. It has taken until recent months for trade policy to more clearly support the USD. Along with long-standing plans for fiscal expansion, Trump’s trade policy should have driven the USD higher in 2017, but just didn’t fit the market narrative at that time.

Politics the catalyst, higher US rates the fuel

The rise in USD borrowing costs has become an issue for a number of emerging market currencies with current account deficits and governments that lack leadership or have strong leaders leading their economies into oblivion. The demise of these currencies has generated broader EM currency weakness and boosted the USD.

The turn for the USD began around end-January when rising US bond yields eventually triggered a broad correction in global equities that have been more volatile ever since. The US equity market keeps getting back on its feet, but it too has been affected by higher US yields, high valuations, increased uncertainty generated by tougher US trade and foreign investment policy, and data privacy issues curtailing Facebook.

A few bad apples in emerging markets, Venezuela, Argentina and Turkey, were under pressure early in the year sending signals that higher USD borrowing costs were starting to bite. A lift, albeit modest at first, in global equity market volatility and credit risk, exacerbated their problems and led to a more general correction in EM markets from around April.

The USD was gaining against EM currencies, and this spread to the EUR and other major currencies due to a combination of softer economic growth in Q1 in Europe and market positioning that was short USD across the board.

European policymakers in both the EU and the UK were convinced that weaker growth in Q1 was temporary, and they would stay on a path to monetary policy normalisation, but Italian politics, Brexit uncertainty, tougher US trade policy rhetoric combined to limit their rebound. The deep troubles in Turkey have added further weight on the EUR, whose banks are more significantly exposed to Turkey than other major economies’ banks.

There may be specific political factors that have been catalysts for weaker markets in Turkey and Italy, but it appears to be the case that higher US rates and yields that contributed to more volatile asset markets since February have made these markets more vulnerable. And, in doing so, propelled a strong, broad recovery in the USD in recent months.

FX remains a tough call

We had warned from late last year that the falling USD was based on a tenuous premise and was unlikely to last as US rates and yields rose.

Forget bitcoin; the real bubble is global equities; 19 December 2017 – AmpGFXcapital.com

Time for the USD to fight-back; 23 February 2018 – AmpGFXcapital.com

We argued that a significant rebound in the USD could unfold from early in April.

A pervasive rise in yields may propel further USD gains; 23 April 2018 – AmpGFXcapital.com

However, it has still not been easy to trade FX. It is one thing to see building risks, it is another to have the confidence to trade it. We have noted the lack of consistent market reaction to developing macro events for some time. Our positions have been small and our resolve to hold them in retracements low.

We can see a case to get on board a long USD trade, but do you sell EUR on a sub-1.15 handle (let alone sub-1.14 where it is now)? Do you sell GBP sub 1.30 or AUD below 0.73? I am not saying I won’t, but it will not be with gusto, and having highlighted the risks that the market was too bearish the USD last year, the time is coming for a reality check the other way.

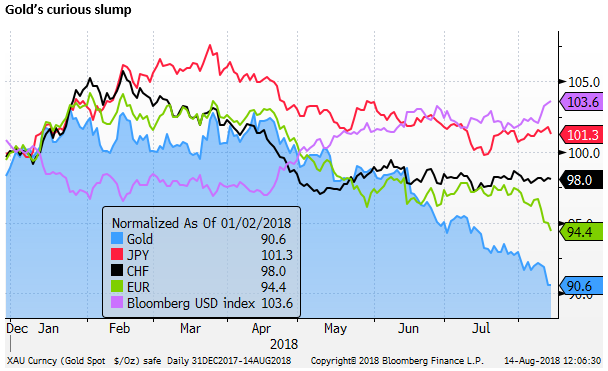

Curious case of missing in action safe-havens

One of the curious parts of the USD rally in the last month or so it the lack of strength in other safe haven assets – gold, JPY, and dare I say in Bitcoin.

Many analysts have argued gold is going down because the USD is strong and US interest rates are going up. Yes, of course, the dollar is strong, why else would gold be weak? A rhetorical question no need to answer.

But, as discussed, a big reason for the USD gains is risk aversion in EM markets. US rates have been falling recently, albeit modestly, on prospects of negative feedback to the US economy. In this environment, gold and JPY would normally be performing better than they have. Gold and JPY may even have risen significantly in past episodes, and analysts would easily have prescribed to the risk aversion case for a bull market in both.

One of my recent trading misadventures was to buy gold/AUD in late-June for precisely this reason. The USD was seemingly harder to call, but risks were growing for EM markets and global growth, so I bought an alternative safe have to the USD (gold) against a non-dollar currency susceptive to a growing trade dispute between the US and China.

Negative feedback from US protectionist policies may boost gold; 26 June 2018 – AmpGFXcapital.com

Gold has fallen like a stone since April, barely pausing to draw breath in recent months as risk aversion in EM markets has increased.

The JPY has firmed gently since mid-July, only after falling significantly in the midst of EM troubles and flat US yields in the first half of July. Granted CHF has taken on a more normal role as a safe haven in the last month, but only against the slumping EUR.

Arguably, the USD should not be the go-to safe haven given its late-cycle fiscal adventure, approaching mid-term elections, erratic president, Mueller investigation, and potential blowback from trade policy.

No broad-based USD funding squeeze

Perhaps there is a genuine need for USD that is a driving influence. This would indeed be a worrying sign and might overpower the desire for alternative stores of value. It might speak to a dollar shortage where corporations and governments can’t access USD lending markets, resulting in a squeeze higher in US rates outside of that guided by the Federal Reserve.

Clearly, in some EM countries, the recent turmoil is making dollar funding more expensive. However, there is not yet evidence of a broad-based scramble for dollars. Indeed with ongoing QE in two major economies and emergency dollar funding avenues employed since the 2007/08 Global Financial Crisis, there is less reason to see a broad-based squeeze in the USD.

Cross-currency basis swaps have widened somewhat in recent weeks, but are narrower than recent years. The Libor-OIS spread has narrowed from earlier in the year. As such, while borrowing USD has become more troublesome for some this year, a broad dollar funding squeeze does not readily explain gains in the USD against alternative safe-havens.

As an aside, the charts above show funding costs for the AUD are more elevated which may speak to a financial vulnerability in Australia, and explain some weakness in the AUD

Has Bitcoin broken gold?

As such, we are left wondering about the poor performance of Gold. Perhaps it is now a buy; it is showing very belated stability in the last day, but you would be advised to approach the tarnished safe haven with caution.

The lack of strength in any alternative safe haven is probably adding to the recent strength in the USD. If you can’t rely on gold, JPY or Bitcoin to hold value, then you are left with the USD.

I have wondered if Bitcoin has broken Gold. Bitcoin attracted enormous attention last year, more than might be explained by a store of value demand, but it was being used in several countries, including China as a store of wealth over the local currency. There are reports of demand picking up in Turkey this year.

Bitcoin’s demise this year reflects a global regulatory backlash, hacking of exchanges undermining confidence in its safety, evidence of manipulation further undermining confidence. There may also be liquidation by legacy holders and those acquiring it via exchange hacks. This has turned sentiment for instrument sour, bursting a speculative bubble. What looked like an innovative disruptor of the traditional global finance industry now appears to be a flawed folly.

Right now you wouldn’t touch it with a barge pole, especially considering the collapse underway in Ethereum once touted as like Bitcoin but even better.

Whether Bitcoin can take its place, one day, as a viable store of value remains to be seen. We are not counting it out. But it appears to be in the midst of a realignment of ownership, washing out of speculators, and overcoming regulatory and market structure weaknesses.

There is not a clear connection from Bitcoin to gold. But if faith in Bitcoin to operate as a safe haven is ruined then investors might also wonder about the efficacy of other established safe-haven assets such as gold. Store of value enthusiasts and speculators may have switched attention from gold to Bitcoin last year. Having been burned in Bitcoin this year, they may not be so eager or able to speculate in gold.

Admittedly I can’t identify a particularly strong reason for the dump in crypto-currencies to undermine gold. But I wonder if gold’s lustre has been dulled by the crypto crash. In the process, it may also be contributing to the rise in the USD more broadly.

The USD is facing its own reckoning

As we write down our thoughts today the USD rally has gained steam against G10 currencies, even as TRL and a number of EM currencies recover from their deep-dive. It is taking on a life of its own, probably dragging in short-term speculators.

But it is time to consider the risks of piling into fresh dollar longs. The dollar is far from a sparkling instrument to hold your wealth. If you are selling TRL to buy USD, you are swapping the currency of one country with a fiscal and current account hole for another. Both Turkey and the USA have an ongoing and arguably uncontrolled need to borrow USD.

You might say – yes, but Turkey has a populist strongman leader with a penchant for controlling the press and interfering in central bank policy. But you could say the same about the USA.

The Trump administration is in an existential battle with the political and legal establishment in the USA. He is in full attack mode against a broad-ranging special inquiry set up by the Justice Department. He has already attacked the central bank for raising rates and accused foreign nations of manipulating their currencies to fall against the USD.

How are Trump and his administration going to cope with a slowing in the US economy, rising inflation or a little financial stress on his own shores? A tip, it’s probably not going to be pretty. Disarray, attack and blame come to mind. Everyone from the Fed, Congress, the media and foreign countries will be a target for blame making it hard for authorities to act with authority.

The USA is not an island that can sustain its calm if global fundamental and markets deteriorate. A key risk for the USD is that the Fed is the only major central bank that has significant room cut interest rates or enact more QE. Prospects for US rate hikes will fade and reverse if stress in emerging markets spreads to global growth confidence and the USA.