UK – from maverick deserter to early-mover with clear purpose

Brexit no longer appears to be a maverick move by a recalcitrant deserter, but an early move in a global trend towards nationalist anti-establishment politics that many countries, especially in Europe, must face. UK PM May is a strong and capable leader and her speech on Tuesday set out clear objectives and a sense of […]

Trump drama and China capital flow crackdown generate market hiccup

The Trump team present a fiery defense against potentially damaging allegations over its conduct, appealing to their loyalist following with a focus on repealing Obamacare, building a wall, attacking the media, and accusing intelligence agencies of Gestapo tactics. The Theatre generated volatility and a further correction in the USD, creating doubts over the capacity of […]

US and global growth to support the USD

US bond yields have spent the year-to-date retracing some of their rapid rise after the US election on 8 November. Concurrent with this correction is a weaker USD, notably against the JPY, but also more generally. However, the US wages data last week tend to confirm that the labor market is now critically tight and […]

Broadening evidence of global economic recovery

In our first note for 2017 we are not ready to draw any significant conclusions for global currency markets. It is evident that a significant correction in the USD has occurred in the first week of the year. This may reflect significantly stronger than expected economic indicators in a range of countries other than the […]

More Trouble for AUD and NZD

Executive Summary

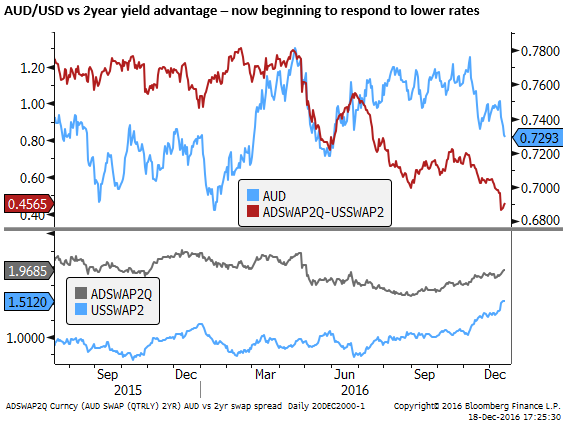

After the recent rise in global yields, AUD and NZD now appear to be in the process of unwinding strength generated by a ‘search-for-yield’ during the first three-quarters of the year. Both currencies have scope to fall to re-connect with narrower yield differentials following rate cuts earlier this year and higher rates in the USA. The bigger source of downside risk for these currencies is the pressure higher global yields may place on domestic economic growth as highly leveraged households face higher mortgage payments. Australian and New Zealand household leverage has risen to new records, exceeding pre-GFC levels, whereas USA household leverage has declined significantly. Australian and New Zealand banks still rely significantly on foreign funding sources. Higher global yields and regulatory pressure to switch to longer term sources of finance are already raising funding costs for Australian banks. Extended housing markets, an apartment glut in Australian cities, and macroprudential policy tightening in New Zealand also generate risks in the crucial housing market. A probable sovereign ratings downgrade in Australia is expected to feed through to somewhat higher mortgage rates in the year ahead. The recent sharp rise in Chinese rates and yields across maturity and credit segments points to financial stress in China generating risks for the Australian and New Zealand economies. Furthermore, both the RBA and RBNZ would prefer a policy mix of a lower exchange rate and higher interest rates, suggesting they will not be an impediment to further significant falls in these currencies.

Image Preview

ECB taper with a twist, Italian risks hover over EUR

The ECB has effectively implemented a taper…although Draghi won’t call it that. It softened the blow with a kind of policy twist including a modest fall in short-term rates. The EUR resolved to the downside after the ECB meeting in what has become an increasingly volatile FX market response to these events. However, we presume […]

Global confidence overcomes Italian uncertainty

Global markets are moving in a classic risk-on fashion so far this week, despite the political upheaval in Italy. Even Italian bonds and bank share prices are relatively stable. Low-yielding safe-havens, JPY, and gold, are weak. And capital appears on the move back to higher yielding and growth leveraged emerging markets and commodities, including their […]

Headwinds stiffen for Australia

We are at an interesting juncture where higher US yields may contribute to stronger USA investor confidence. Businesses may sense that the interest rate cycle has turned encouraging them to accelerate plans to borrow and spend. On the other hand, higher-yielding countries that have experienced a rise to record and dangerous levels of household debt, […]

USA economic momentum may sustain dollar rally into year end

The market is churning as it awaits key events this week, the OPEC meeting, Italian referendum, month-end position squaring. Oil prices slipped as hopes of a deal on Wednesday fade. This has taken some steam out of the rise in global yields and the USD/JPY. Italian bonds and equities have rebounded, pairing losses ahead of […]

Trump’s anti-globalization policies atop his agenda

There are a lot of moving parts in global financial markets that are yet to come together and make a cohesive narrative for global investors. For one there are the immediate economic trends that may have taken a backseat recently to the longer term implications of a Trump presidency. The USA has exhibited somewhat firmer […]